Archives

May 2020

Categories

All

|

Back to Blog

COVID-19 Mortgage Forbearance4/6/2020

COVID-19 is affecting many business collection practices. If your bank is anything like mine, you got an email notification that they were offering payment deferrals for mortgages and credit card customers. In this post, we're going to take a look at what deferred payments or a forbearance looks like in your mortgage account should you choose one and what are the pros and cons of a mortgage forbearance.

Forbearance is when you and your mortgage company agree to temporarily suspend or reduce your monthly mortgage payments for a specific period. This allows you to deal with short-term financial problems by giving you time to get back on your feet and bring your mortgage current. Keeping your word is paramount in this situation. Do not make commitments you can't keep. You may have to go back to your creditors for additional relief. Broken payment promises may make them less likely to provide help. You should contact your mortgage servicer to see what terms are offered. Doing so will help you better understand your options. It is always better to contact a creditor before you get behind on payments. You have to request and qualify for forbearance. If you have a federal loan (FHA, VA, USDA), your qualification is guaranteed during the COVID-19 pandemic. A forbearance allows you to maintain your cash as you navigate through a temporary crisis. Typically, the forbearance is for three months. You don't have to pay your mortgage during a forbearance. That deferred monthly payment becomes a cash cushion for you during this time. Understand a 'deferred payment' doesn't mean a 'never payment.' You will eventually have to make up any deferred payments. Please read the previous two sentences again. Deferred payments may accrue additional interest and extend the length of your mortgage, depending on the forbearance terms. If your monthly payment includes an escrow amount, that will also be deferred. That will create an escrow shortage. An escrow shortage will increase your monthly mortgage payment escrow amount the next time your servicer does an escrow reconciliation. Be aware and prepare for such an eventuality. Escrow shortages and reconciliation timing can create future monthly mortgage payment volatility. You can pay your escrow amount during the forbearance to prevent a deficiency. If you decide to do this, verify your partial payments are credited to your escrow balance. Before you agree to the forbearance, understand how it will report to the credit bureaus. Most lenders will not report your account to the credit bureaus during the forbearance, if you abide by the terms of the forbearance. The credit score impact of a late monthly mortgage payment can be devastating and long term. Most new credit scoring models more heavily weigh mortgage than other types of payments when calculating your payment history. Some newer credit scoring models treat late payments during a natural disaster less harshly. Surely the COVID-19 pandemic is a natural disaster. In times of financial uncertainty, cash on hand gives you options. A deferred payment doesn't increase your income. It lowers your outgo. During such times, reducing your monthly obligations is prudent. You can always pay your mortgage during or after the forbearance. Should you take a mortgage forbearance offered during the pandemic? For the vast majority of borrowers, that answer would be yes. A lot depends on where you are on the pandemic financial disaster scale. There are three benchmarks on the scale:

Regardless of your situation, your deferred payments are not for vacations, entertainment, clothes, and other things "you deserve or owe to yourself." Do not use debt to finance your wants. Wants are why you have savings accounts. Beware of "easy money." Don't get greedy and let a short-term decision lead to long-term financial turmoil. Here are two other considerations. First the less time you have left on your mortgage, the more impractical a forbearance. Since now, the majority of your payment is going toward extinguishing your principal and not interest. In such a situation, access forbearance in an extreme emergency only. Second, home equity line of credit (HELOC) loans are considered revolving accounts by most banks and generally don't offer traditional mortgage forbearance. Even though the loan is secured by your home. Most lenders will try to assist, if you need it. No one knows the final impact of the virus or how long the pandemic will last. Every family is sure to be buffeted by its economic turbulence. Society will respond in various ways. There are future financial decisions to be made. But for now, taking a mortgage forbearance makes sense for a lot of us.

0 Comments

Read More

Back to Blog

11 Benefits of a Great Credit Score7/2/2019 A great credit score is 750++ on all credit scoring models. Having such scores is an important part of living a MoneySmartLife.

Here are 11 benefits of having and maintaining great credit scores.

Back to Blog

MICHIGAN PROPERTY TAX APPEAL PROCESS12/14/2017

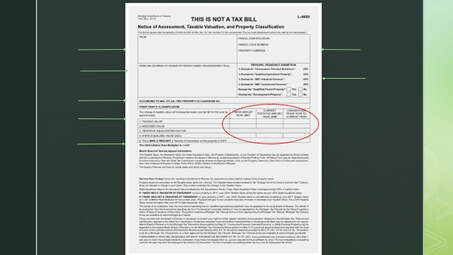

The window envelope comes from your Municipal Tax Assessor’s office. Your muscles tense. Your thoughts focus. Wasn’t the mortgage company suppose to handle property tax stuff? Who needs another bill. Your adrenaline has kicked in to help you face this “threat.” It sharpens your focus.

You nervously open the envelope. Its contents scream in large bold font across the top “THIS IS NOT A TAX BILL.” Relief washes over you as you put the notice down, one of the biggest mistakes that homeowners make. Because if you take the time to read and understand this form, you will reduce the amount of taxes you pay on your home for years.

Homeowners in their first year of ownership should pay particular attention. If this is the first year owning your home, then one of the most important things you can do is to make sure that your property is assessed correctly in the first year of ownership. Transfer of Ownership is a significant taxable event in Michigan. Transfer of Ownership includes not only purchases but inheritance, divorce, probate, etc.

Ignoring this can cost you thousands of dollars over the life of your homeownership. The first year of ownership is the only time your state equalized value (SEV) will be the same as your taxable value. The reset of SEV and taxable value can substantially raise a new homeowner’s property taxes during the first two years. That is called the “pop-up tax.” You want your taxable value to start as low as possible. The only way to get it done is to appeal your property tax assessment. The good news is that it’s not hard to do. Since you just bought the house, you probably have all the documentation you need to make a strong appeal.

Back to Blog

|

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed