Archives

May 2020

Categories

All

|

Back to Blog

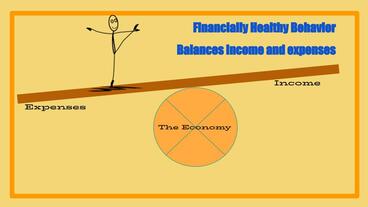

The next financially healthy behavior in our series is “balances income and expenses.” Balance is a state of being. We strive to achieve balance in life. When it comes to money, there is much to balance. Wants vs. needs; long-term goals and short-term goals; security vs. risk-reward; retirement savings vs. spend now; debt service and discretionary income; etc. Imagine yourself standing in the middle of a long plank balanced on a large ball. One side is expenses, and the other is income. Your spending choices and realized income opportunities determine how much is added to each side of the plank. The ball represents macro-economic factors that may change. Your goal is to maintain balance. Maintaining your balance requires constant motion. Balance doesn’t necessarily need equilibrium to be successful. Maintaining balance involves attentiveness to details and mini-corrections. Add some to one side or take from the other. Repeat as necessary. The sides of the plank are not equally weighted. The expense side of the plank is weighted from birth. Humans are an expense from birth to economic viability. Economic viability is when a person is contributing more in value than they are consuming in resources. This even applies to trust fund babies. But they also come with a preloaded income side. It is easier to maintain balance than it is to achieve it initially. From birth, most working-class families, especially the legacy dispossessed, are crawling up the expense side of the plank trying to attain balance. Unfortunately, they must make that journey through a hostile environment. One filled with “trick and trap” financial services (payday loans), targeted economic disinformation (debt consolidation), and the need to make sophisticated financial and investment decisions (401k). Many are ill-equipped to do so. The financially ill-informed are the prey of financial services predatory capitalists. “Experience is a hard teacher because she gives the test first, the lesson afterward.” Vernon Law. Trial and error is not an option for most. Recovery is often not easy from such money lessons that extract resources from the already low-resourced, which could also lead to foreclosure or bankruptcy. Additionally, there are extended periods of imposed financial purgatory, effectively barring access to other products and services. These higher standards and lower limits for future borrowing are imposed over a lifetime. The reason there are no non-white Walt Disney or Donald Trump is non-whites don’t get the chance to have multiple bankruptcies. It is one and done. Win or go home. Rather win or lose your home. Here are some things to help you balance income and expenses: MAXIMIZE INCOME

0 Comments

Read More

Your comment will be posted after it is approved.

Leave a Reply. |

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed