Archives

May 2020

Categories

All

|

Back to Blog

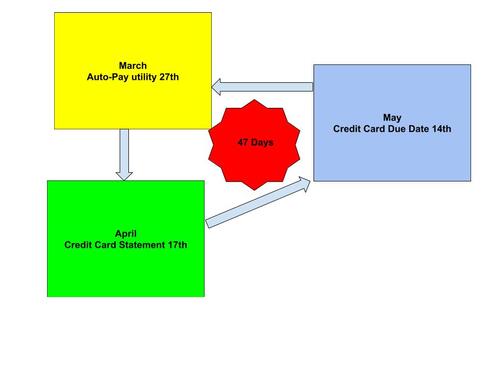

There is a way to keep your money longer by using credit cards and autopay. I have been using this strategy successfully for several years. It has evened out my cash flow and put cash and rewards in my pocket. This strategy is only valid if you pay your credit card statement balance in full every month. Here how it works. DATES are important. You need credit cards with different closing dates throughout the month. Credit card transactions are billed at set times called billing cycles. The last day of the billing cycle is the account statement closing date. The due date is the date by which you must pay your credit card statement balance. There is a grace period between the statement closing date and the payment due date. By law, the credit card company is required to offer a grace period of at least 21 days. This is the time from your statement closing date you get to make a payment before interest is charged on new purchases. That is 21 more days to keep your money. The credit cards I use:

All transactions since the last closing date will be included in your credit card statement. Credit card transactions are billed at set times called billing cycles. The last day of the billing cycle is the account statement closing date. You have a grace period between the statement closing date and the payment due date that’s roughly between 21 and 25 days, depending on the card you have. Your card has a grace period, The credit card company is legally required to offer a grace period of at least 21 days. This the time from when you get your statement to make a payment before interest is charged on new purchases.

I use this strategy with reward credit cards for cash back or travel rewards to help maximize the benefits. I love accumulating miles from paying for utilities. I use the same strategy for cell phones, cable/internet, streaming subscriptions, and natural gas. If you actually deposit the deferred payments into an interest-bearing account, you may even see a modest gain over a year. Other considerations Monitor your credit card statements carefully. Auto-pay amounts may change. I do not auto-pay my credit cards. This forces me to interact with the website to pay the bill. Therefore I get to monitor my statement before I make my payments. Using this strategy will allow you to pay your bills on time and keep your money longer while doing it.

0 Comments

Read More

Back to Blog

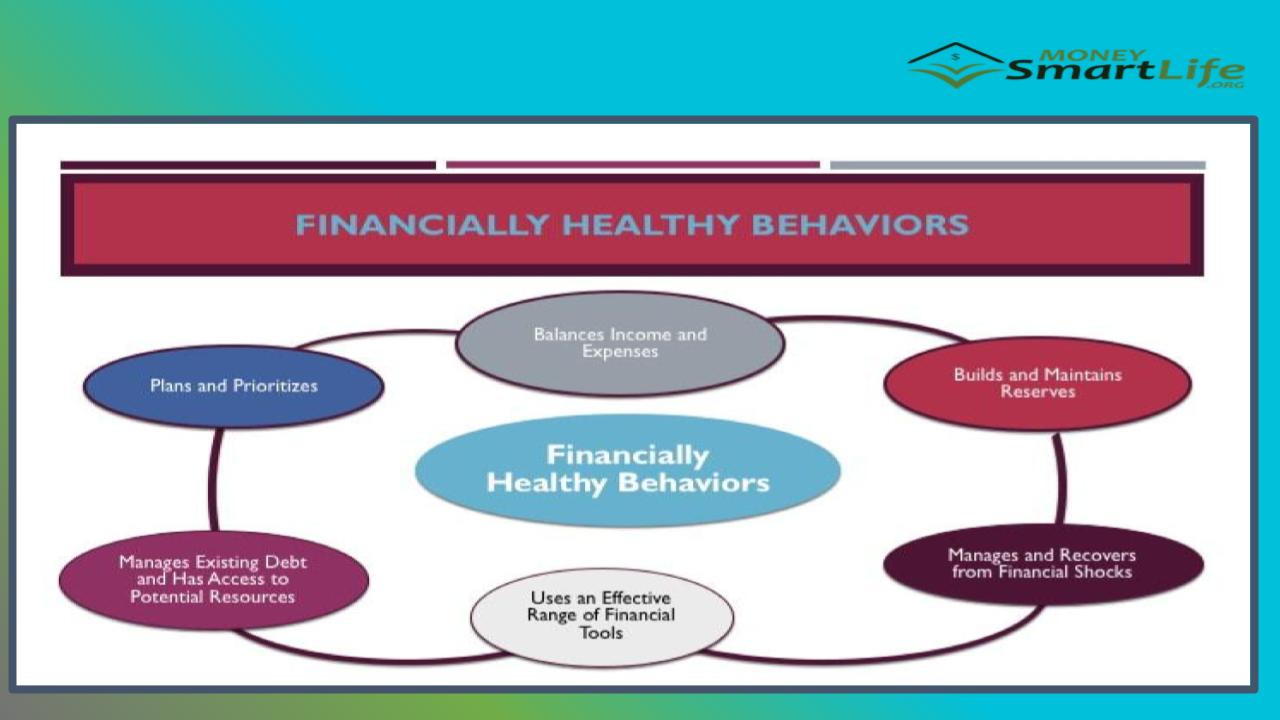

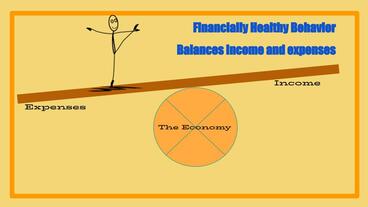

The next financially healthy behavior in our series is “balances income and expenses.” Balance is a state of being. We strive to achieve balance in life. When it comes to money, there is much to balance. Wants vs. needs; long-term goals and short-term goals; security vs. risk-reward; retirement savings vs. spend now; debt service and discretionary income; etc. Imagine yourself standing in the middle of a long plank balanced on a large ball. One side is expenses, and the other is income. Your spending choices and realized income opportunities determine how much is added to each side of the plank. The ball represents macro-economic factors that may change. Your goal is to maintain balance. Maintaining your balance requires constant motion. Balance doesn’t necessarily need equilibrium to be successful. Maintaining balance involves attentiveness to details and mini-corrections. Add some to one side or take from the other. Repeat as necessary. The sides of the plank are not equally weighted. The expense side of the plank is weighted from birth. Humans are an expense from birth to economic viability. Economic viability is when a person is contributing more in value than they are consuming in resources. This even applies to trust fund babies. But they also come with a preloaded income side. It is easier to maintain balance than it is to achieve it initially. From birth, most working-class families, especially the legacy dispossessed, are crawling up the expense side of the plank trying to attain balance. Unfortunately, they must make that journey through a hostile environment. One filled with “trick and trap” financial services (payday loans), targeted economic disinformation (debt consolidation), and the need to make sophisticated financial and investment decisions (401k). Many are ill-equipped to do so. The financially ill-informed are the prey of financial services predatory capitalists. “Experience is a hard teacher because she gives the test first, the lesson afterward.” Vernon Law. Trial and error is not an option for most. Recovery is often not easy from such money lessons that extract resources from the already low-resourced, which could also lead to foreclosure or bankruptcy. Additionally, there are extended periods of imposed financial purgatory, effectively barring access to other products and services. These higher standards and lower limits for future borrowing are imposed over a lifetime. The reason there are no non-white Walt Disney or Donald Trump is non-whites don’t get the chance to have multiple bankruptcies. It is one and done. Win or go home. Rather win or lose your home. Here are some things to help you balance income and expenses: MAXIMIZE INCOME

Back to Blog

Income & Expense Volatility Income & Expense Volatility

One of the four financial health influencers is the volatility of income and expenses. Households impacted by such volatility find it difficult to achieve financial well-being. Increased expenses or reduced income often dictate tough lifestyle choices and increase stress levels beyond chronic. When there is increased income or reduced expenses, there is a less problematic increase in household discretionary funds and the fun that goes with it. Seasonal workers, those on fixed incomes, or subject to inconsistent hourly work schedules are especially vulnerable to this type of volatility.

These financial shocks can have a devastating effect. Income and expense volatility does not have to impede your pursuit of 6 Financially Healthy Behaviors. Volatility can be mitigated by preparing for it. John F. Kennedy once said, “The time to repair the roof is when the sun is shining.” Please don’t wait for it to rain before you prepare. One cause of volatility is “stuff happens.” Happens to everybody. No one is immune. To achieve financial well-being, you need to possess the “capacity to absorb financial shocks.” Economic setbacks can be self-inflicted or come from external sources. The future economy will be disrupted by geopolitical, weather, or cyberattack events. It is essential to be able to manage and recover from the inevitable financial shocks. Every household should have a disaster recovery plan. The foundation of a financial recovery plan is the Emergency Fund, the “liquidity buffer” between you and ruin. Building an emergency fund is your #1 priority, no matter your age. You should well establish an emergency fund before you divert resources to a debt reduction strategy. Emergency funds are highly individualized. Sufficiency depends on a variety of factors, including your health, your age, your temperament, dependents, housing situation, the stability of your job, your risk tolerance, and more. Just be mindful of the truism, “It’s better to have money and not need it; than to need it and not have it.” Your emergency fund can’t be too big. Its size may determine how it is stored but not its existence. 4 Ways to Jumpstart an Emergency Fund

Being able to deal with income and expense volatility successfully requires preparation. The base of that preparation is an emergency fund. Start or grow yours now.

Back to Blog

Have a Better Holiday Family Gathering11/18/2019  Holidays are times of gathering for families. As such it provides opportunities to help the extended family strengthen its economic foundation. These are the perfect times to discuss estate plans, elder care, custodial expectations and more. Now that sounds pretty heavy and it may be depending upon how your family views these subjects. But not talking about it isn’t wise. Normally estate matters are resolved as part of a process that takes time to complete. But they must be started. Start with the easy stuff. Are wills in place for all adults 18 years and older? What happens to the kids? Are there durable power of attorneys and health care directives in place for all adults 18 years and older? It is better to have these discussions before a crisis requires them. Not having proper estate plans in place has put significant stress on family relationships regardless of assets forever. Yours will be no different. Take the next steps depending on what is learned. Help those that have no plan get one written and recorded. Encourage those that have a partial plan to upgrade. Lead by example. Family gatherings can also provide opportunities to save money through the elimination of redundant streaming services expenses. Most streaming services allow for multiple profiles or device logins. Maximizing profiles used for each service and spreading the cost of the subscriptions can expand extended family access while lowering individual unit costs. This is also a time to review subscription services already shared to see if they are still used and eliminate those that aren’t. Some services can be eliminated seasonally depending upon demand. The family can adopt a “binge and go” strategy. This is where a service is subscribed to for a period of time to allow episodes to be binged. The effect is to make the service disposable, use it then lose it. This eliminates autopilot spending that subscriptions require. Here is a list of some popular subscription streaming services and links to their multiple user policies:

Back to Blog

Living paycheck to paycheck is hard because there never seems to be enough money, ever. Being “broke” all the time ain’t no fun, that’s for sure. Especially if you make a “decent” income and know you should be doing better. This also encourages the unsustainable use of debt for lifestyle support.

It's not just how much money comes in and how much money goes out. It's also when does money come in, and when does it have to go out? That's called cash flow. If you manage your cash flow properly, you can reduce your stress and survive short term minor financial shocks. The steps to proper cash flow management:

A lot of times you'll have more dates with money going out than you do money coming in. It’s not just the date when money has to go out, also its relative size to the money coming in has an impact as well. For example when a rent payment requires most of a pay period check. My first confrontation with cash flow was during my first job. Newly married at 22, totally inexperienced at handling money. While also suffering from early-onset testosterone poisoning better known as “stupid looking for somewhere to happen” that silently infects so many American males. My beautiful young 20-year-old bride did not have much experience with money either. We were properly raised in Black middle class families where money was a closely held secret revealed only on a need to know basis under the penalty of death if revealed to anyone. I got a job working for 3M Co as a territory sales rep. In 1973, my starting salary out of graduate school was $800 per month, paid once a month at the end of the month. That was all the income we had. Besides the salary, the job came with a company car. And they also reimbursed expenses bi-weekly, such as gas for the company car and meals with clients. Being paid once a month will force you to learn how to manage money. Unfortunately, we made a ton of errors on the way to that knowledge. There was always seemed to be “a lot of month left at the end of the money.” It was a stressful way to live and led to an unmanageable debt load that would accompany us for years. I remember one particularly painful month when my wife made a simple arithmetic mistake in the check register. (These were the days before digital calculators, nevertheless ATMs, computers, or apps.) The account was overdrawn and there was nothing that could be done about it until next payday. Of course, the bank had no problem racking up overdraft fees throughout the month and immediately subtracting them from the next deposit. This made a bad situation worse and prolonged the pain for additional months. I left that job for another job that paid more money more often, from once per month to every two weeks. The biggest change besides the slightly larger income was going from 12 to 26 paydays per year. That change lowered our stress and increased our capacity to save aggressively and spend wisely. You can also use your credit card to control due dates. This is a strategy that is especially effective with multiple cards and delivers rewards as well. Remember cash flow is impacted by how much goes out and also when it goes. Using a credit card to pay an obligation can effectively extend its due date and allow you to retain your funds longer. Using a series of credit cards with rotating closing dates to pay routine obligations such as utilities, insurance premiums, etc can improve your cash flow and buffer unexpected increases. To use this strategy you must pay your credit card statement balance in full each month by the due date. The 3 fundamentals of good cash flow management are simple and evergreen:

|

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed