Archives

May 2020

Categories

All

|

Back to Blog

MICHIGAN PROPERTY TAX APPEAL PROCESS12/14/2017

The window envelope comes from your Municipal Tax Assessor’s office. Your muscles tense. Your thoughts focus. Wasn’t the mortgage company suppose to handle property tax stuff? Who needs another bill. Your adrenaline has kicked in to help you face this “threat.” It sharpens your focus.

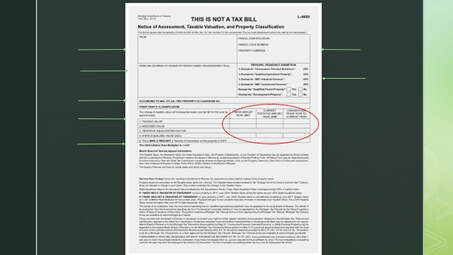

You nervously open the envelope. Its contents scream in large bold font across the top “THIS IS NOT A TAX BILL.” Relief washes over you as you put the notice down, one of the biggest mistakes that homeowners make. Because if you take the time to read and understand this form, you will reduce the amount of taxes you pay on your home for years.

Homeowners in their first year of ownership should pay particular attention. If this is the first year owning your home, then one of the most important things you can do is to make sure that your property is assessed correctly in the first year of ownership. Transfer of Ownership is a significant taxable event in Michigan. Transfer of Ownership includes not only purchases but inheritance, divorce, probate, etc.

Ignoring this can cost you thousands of dollars over the life of your homeownership. The first year of ownership is the only time your state equalized value (SEV) will be the same as your taxable value. The reset of SEV and taxable value can substantially raise a new homeowner’s property taxes during the first two years. That is called the “pop-up tax.” You want your taxable value to start as low as possible. The only way to get it done is to appeal your property tax assessment. The good news is that it’s not hard to do. Since you just bought the house, you probably have all the documentation you need to make a strong appeal.

Appealing your property tax assessment requires evidence and strategy. Should I appeal? What am I requesting? To answer those questions, you need to understand the four interdependent “VALUES” that control how much property tax you pay. These values change every year. When they go up--as they do more often than not--you will pay more taxes.

Here is a quick overview of the values. Follow the links for more details. 1. True Cash Value (TCV) The price your home would sell for in an arm’s length transaction between a prudent buyer and prudent seller.

So if you look at all four, it is the taxable value (TV) that determines your property tax-paying destiny. The lower you get taxable value, the less tax you pay. Take note that you can successfully appeal to lower your SEV, AV, and TCV and still not change the amount of taxes you pay. The longer you have owned your home, the more likely this is the case. The most significant difference in the four values is Taxable Values are capped. In contrast, True Cash Value, Assessed Value, and State Equalized Value are unrestrained. Proposal A insulates homeowners from the risk of rapid property appreciation taxing them out of their homes. It also can create significant disparities between Taxable Value and State Equalized Values for long term homeowners. So if you cannot get your SEV below your Taxable Value your taxes will not go down. Don’t appeal. To lower SEV, you must lower AV. To lower AV, you must lower TCV. That requires proof of a lower valuation from you.

Now that you have decided to appeal your Michigan Property Taxes

The Board of Review is also responsible for hearing appeals of residents who are unable to pay property taxes due to their financial situation. The Board of Review also meets in July and December only to consider hardship applications, correct mistakes, grant hardship exemptions for late filers, and to reinstate rescinded exemptions. There is a lot of anecdotal evidence of success in appealing property taxes.

0 Comments

Read More

Your comment will be posted after it is approved.

Leave a Reply. |

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed