Archives

May 2020

Categories

All

|

Back to Blog

Where are you on the COVID-19 Pandemic Financial Experience Scale? Working-class people are experiencing this pandemic very differently financially. There are 3 benchmarks on the scale. This is a look at the second benchmark, "Treading."

TREADING MODE For you, the crisis is disruptive but not destructive. You have some reserves and a safety net. You are experiencing diminished income. You can maintain most of your lifestyle with a combination of reduction of non-essential expenses and subsidies from your stockpiles of food and finances. There are finite amounts of those resources available. Here are some tactics you can use to help you maintain the status quo for a while.

Credit card forbearances can be tricky. It's all about the interest and how it reports to the credit bureaus. I've heard of some very generous terms. ‘Current balance held at no interest until paid in full as serviced by a minimum payment.’ It is also reported to the credit bureaus as "paid as agreed." If you currently have a statement balance that amounts to an interest-free loan instead of the legally usurious interest rates credit cards charge now. Double-check to see if the terms apply to cash advance balances also. Often you "voluntarily" agree not to use the credit card during the forbearance period. If your credit servicer is not offering generous terms, make your minimum monthly payment during the pandemic. (If you are unable to make your minimum monthly payments, you are in Surviving mode.) Keeping your word is paramount in this situation. Do not make commitments you can't keep. You may have to go back to your creditors for additional relief. Broken payment promises may make them less likely to provide help.

0 Comments

Read More

Back to Blog

Where are you on the COVID-19 Pandemic Financial Experience Scale? Working-class people are experiencing this pandemic very differently financially. There are 3 benchmarks on the scale. This is a look at the first benchmark, "Surviving."

SURVIVING MODE This crisis caught you unprepared. You have limited resources anda fragile safety net. Your income is gone. Your lifestyle is in jeopardy. Your standard of living is diminished. You have done all you know to do. The stress and pressure are negatively affecting you, physically and emotionally. You’ve gone from making savings and debt reduction decisions to housing and food insecurity. Your financial focus (time, talent, and treasure) has shifted from working on longer-term goals to money shortage problem-solving. You see very little if any light at the end of the tunnel. Your future looks bleak. You need a miracle. So, position yourself for one. Here is how to activate the power of God in your financial life, on purpose. Become a hardcore, no turning back, tither of your gross income. Tithing is a covenant between you and God. It is a contract that He offered. It is a lot like those “terms of use” agreements we get when we download a new app. It is pretty much, “take it or leave it.” If you don’t agree, you won’t get the benefits of the app. To get the benefits of tithing, you must sign the agreement. You do that by making a commitment to tithe. Then demonstrate that commitment by your future behavior. If you do that, God promises to meet all your needs. The context of this promise is to individuals who had not tithed in the past, like you. Despite that, they were offered a fresh start. That is true for you also. Grace and Mercy will overcome your guilt and history financially. The point is to start and don’t stop. It is controversial whether the tithe applies to the New Testament dispensation. It is not controversial to me. When I made my commitment to tithe, “I was so broke I couldn’t pay attention.” My conversation with God went like this. “Okay, Lord, You said if I tithed, You would bless me and mine. If You bless me, I’ll go tell it. And if You don’t bless me, I’ll go tell that too.” That was not a threat to God but rather a promise to give Him a Yelp review. That was about 4 decades ago, and I have never looked back or regretted the decision. “Five stars, Outstanding customer service.” “Blessed” means different things to different people. Here are some of the elements I consider when I say, “I’m blessed.”

Get your eyes off the promise and turn them toward the Promise Keeper. Now that you have started tithing, you rightfully expect a return. However, tithing is not an investment. Your focus should not be on the timing and size of the promised return. Instead, your focus should be on pleasing God. Remember, He provides daily. Be wary of those who preach to your desperation and not to your faith. Tithing requires you to give your money away. Where you give your money is important. Because of the prevalence of “prosperity preachers and famine feeders” making appeals, the tithing message can be easily distorted to appeal to your need. Give to them, and you will receive, you are told. That appeals to your need. You don’t give to get, no matter how great your need. You give to honor God. Your motive is just as important as your behavior. When you give, be sure it is for the right reason and not because of a compelling appeal. Miraculously changing your financial life requires a change in behavior. Behavior changes are not easy. Changes of behavior require commitment. Commitment is demonstrated by behavior. Tithing is a behavior. And just like with exercise and oral hygiene, consistency is what brings long-term results. The COVID-19 pandemic has forced you into a desperate situation. Your options are few and dwindling. Your situation seems beyond your capacity to solve. You need a miracle. Position yourself for a lifetime of miraculous provisions by being a hardcore tither. What have you got to lose? You don’t have enough to make it now, anyhow, right? Honor God with your tithe and experience His provision and more. True, you don't have to be a tither to be blessed by God. However, I have never seen a tither not blessed by God. No, not one.

Back to Blog

The COVID-19 pandemic has affected every American family. The severity of the impact varies based on socioeconomic and demographic factors. For most working-class people, the result will be short-term economic devastation due to the loss of income, health benefits, and savings. It does not matter where your family is on the pandemic financial disaster scale, The pandemic left working-class families worse off. The economic toll has yet to be calculated.

At the time of this writing, the economic situation is very fluid. Without income, families are in housing default or food insecurity. The longer it goes on, the more widespread the economic suffering will be. The final impact on your family’s financial well-being may be unknowable and out of your control. What is in your control is resilience. Resilience is an integral part of financial well-being. As any world-champion prizefighter would tell you, “It is not just how hard a punch you threw; but also how hard a punch you took that matters.” Stuff happens in life all the time. We don’t know its name and duration until it happens. “COVID-19 pandemic” is this large steaming pile of stuff’s name. And when stuff happens, you have to deal with it. To continue to torture the prizefight analogy, “In life, it is not that you got knockdown. Instead, it is how long you stay down and what you do after you get up that determines the outcome.” So no matter how hard you got knockdown. Get up. Here is how. 1. Start Planning Your Comeback Now While You Are Going Through. Focus on what you want your life to be. Set short-term recovery goals. What do you have to do to keep your vow “not to be caught like this again?" Start or add to your Emergency fund.. Restock or build your Food bank. Build and improve Relationships with members of your safety net. Vote. Engage with all levels of civic government. Understand the impact of civic appropriations and taxiing decisions and whose interests are benefited by those decisions. Then vote your interests. Local, state and the federal government should be run competently with an adequately resourced staff of honest public servants. Also, there should be citizen oversight with political and criminal accountability. 2. Stay In The Moment. Every day has its own supply of challenges and joy. You can’t know the future, good or bad. Don’t create horrible future mental scenarios. Focus on making informed good choices now. The right decisions lead to good outcomes. Why worry about tomorrow? Doing so will not add an hour to your life. Matt 6:34 3. Believe In Yourself. You can do this. You don’t have to know every step of how. Just do the best you can each step of the way. Remember, you are playing a long game. Your outlook is post-pandemic. Don’t let a short-term decision lead to long-term financial turmoil. 4. Trust in God. If you believe He provides, then face each day with confidence. 5. Give. Don’t be so inward-focused. Turn your attention outwards and help others less fortunate than yourself. 6. Maximize Self-Care to mitigate the stress and depression that your situation fosters. In every airline pre-flight video, you are instructed to put on your own oxygen mask first. Only then help others in the event of a loss of cabin pressure. Money troubles increase pressure. You must find a way to release it before hurting others, generally those closest to you. For additional information on mental Resilience.

Back to Blog

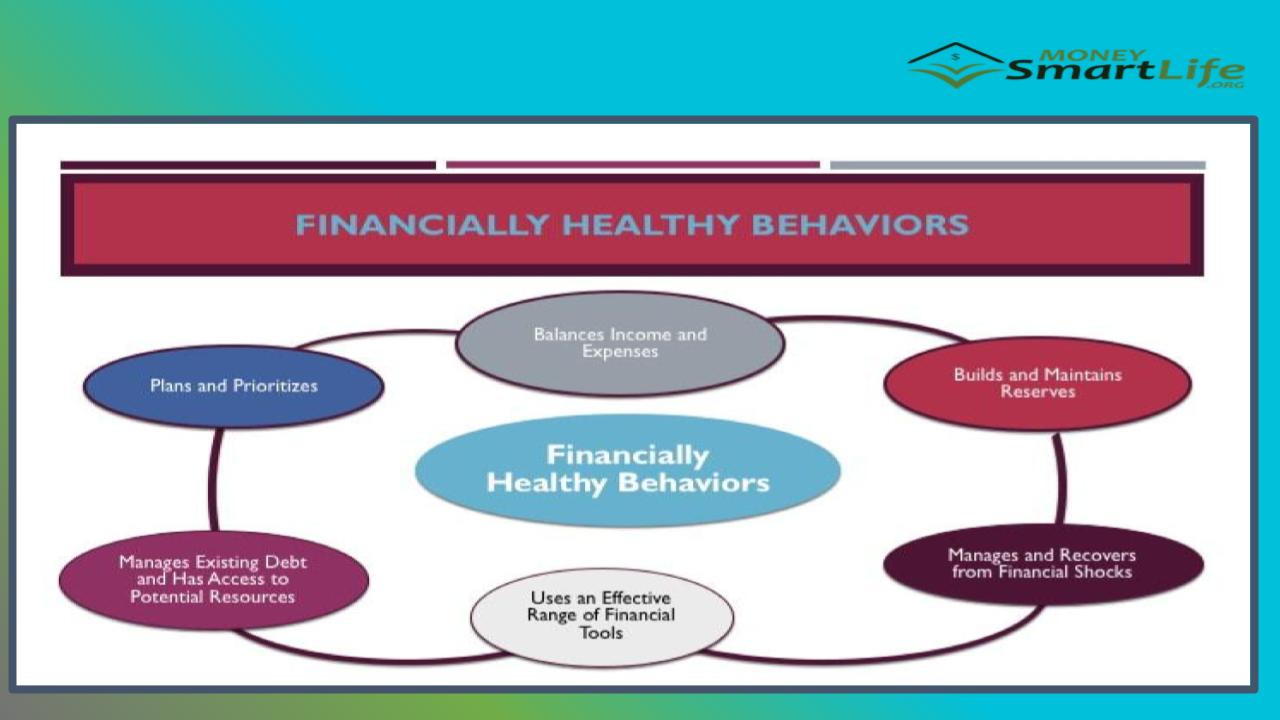

Your behavior is one crucial factor that determines your financial well-being. It is not just what you know to do, but what you actually do that counts. Knowing you must save for retirement is different than saving for retirement. Knowledge should inform behavior not to be a substitute for it.

The next behavior in our look at six financially healthy behaviors is managing existing debt and has access to potential resources. This is your skills and ability to control your debt. And your capacity to generate outside resources in times of need. Let’s take a look at each. Manages Existing Debts

Back to Blog

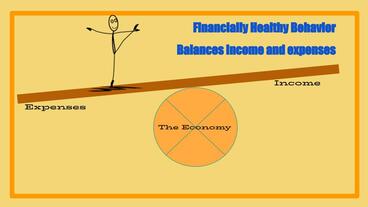

The next financially healthy behavior in our series is “balances income and expenses.” Balance is a state of being. We strive to achieve balance in life. When it comes to money, there is much to balance. Wants vs. needs; long-term goals and short-term goals; security vs. risk-reward; retirement savings vs. spend now; debt service and discretionary income; etc. Imagine yourself standing in the middle of a long plank balanced on a large ball. One side is expenses, and the other is income. Your spending choices and realized income opportunities determine how much is added to each side of the plank. The ball represents macro-economic factors that may change. Your goal is to maintain balance. Maintaining your balance requires constant motion. Balance doesn’t necessarily need equilibrium to be successful. Maintaining balance involves attentiveness to details and mini-corrections. Add some to one side or take from the other. Repeat as necessary. The sides of the plank are not equally weighted. The expense side of the plank is weighted from birth. Humans are an expense from birth to economic viability. Economic viability is when a person is contributing more in value than they are consuming in resources. This even applies to trust fund babies. But they also come with a preloaded income side. It is easier to maintain balance than it is to achieve it initially. From birth, most working-class families, especially the legacy dispossessed, are crawling up the expense side of the plank trying to attain balance. Unfortunately, they must make that journey through a hostile environment. One filled with “trick and trap” financial services (payday loans), targeted economic disinformation (debt consolidation), and the need to make sophisticated financial and investment decisions (401k). Many are ill-equipped to do so. The financially ill-informed are the prey of financial services predatory capitalists. “Experience is a hard teacher because she gives the test first, the lesson afterward.” Vernon Law. Trial and error is not an option for most. Recovery is often not easy from such money lessons that extract resources from the already low-resourced, which could also lead to foreclosure or bankruptcy. Additionally, there are extended periods of imposed financial purgatory, effectively barring access to other products and services. These higher standards and lower limits for future borrowing are imposed over a lifetime. The reason there are no non-white Walt Disney or Donald Trump is non-whites don’t get the chance to have multiple bankruptcies. It is one and done. Win or go home. Rather win or lose your home. Here are some things to help you balance income and expenses: MAXIMIZE INCOME

|

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed