Archives

May 2020

Categories

All

|

Back to Blog

The Detroit city government fraudulently overtaxed Detroit property owners during the Kilpatrick, Cockrel, Bing, and Duggan administrations. The resulting tax delinquency foreclosures led it to the systematic dispossession of Detroit homeowners by the government. The burden was disproportionately borne by those whose properties had lower values and could least afford it.

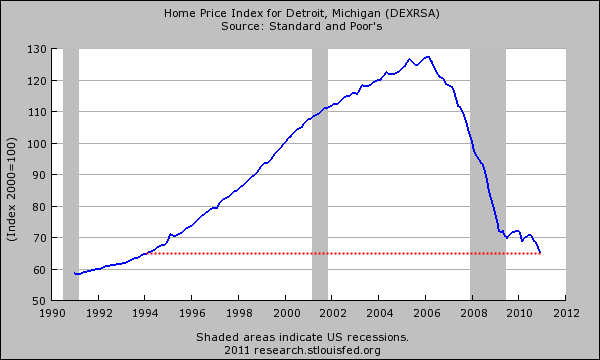

At the height of the recent economic crisis, Detroit assessed residential properties at market values that did not reflect what was happening to Detroit’s real estate. Valuations for tax purposes were going up. In reality, property values were going down, fast and hard. The city government systematically inflated the property tax assessments of homes in Detroit beyond the legal limit.

Starting in 2008, home values in Detroit plummeted as a result of the Great Recession. Instead of reducing property tax assessments to match the lower cost of homes, the government maintained the previous higher assessed value. The Michigan Constitution sets property assessments at no more than 50% of market value. That value is known as the State Equalized Value or SEV.

1 Comment

Read More

Back to Blog

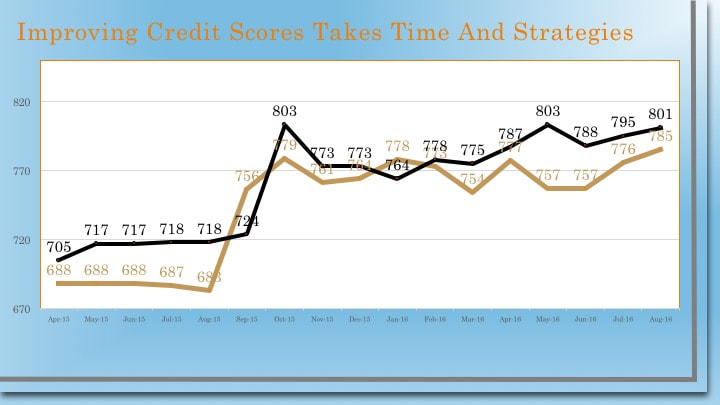

Is a Balance Transfer Right for You?11/24/2017  It is difficult to give generalized financial advice. Because everyone’s situation is different and the dollars are in the details. Having said that, here's a look at the benefits of a balance transfer. A balance transfer is when you move the debt from one debt instrument to another. In most cases, a credit card is the receiving instrument. Some pros to doing a balance transfer.

Some things you should be aware of when making a balance transfer.

Back to Blog

Back to Blog

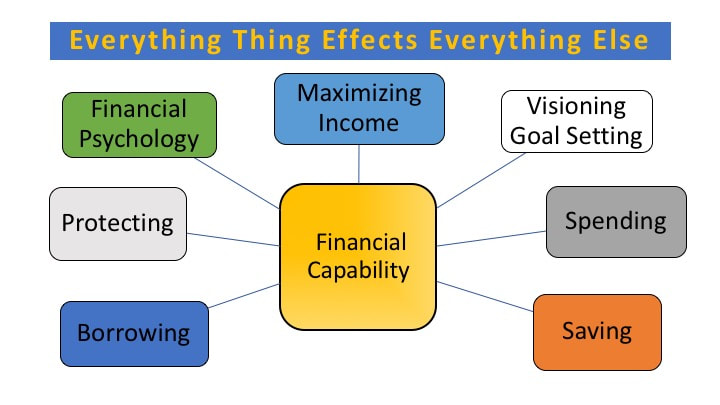

Everything Effects Everything Else11/17/2017 Financial capability is the internal capacity to act in one's best financial interest, given socioeconomic environmental conditions. It therefore encompasses the knowledge, attitudes, skills, and behaviors of consumers with regard to managing their resources and understanding, selecting, and making use of financial services that fit their needs.

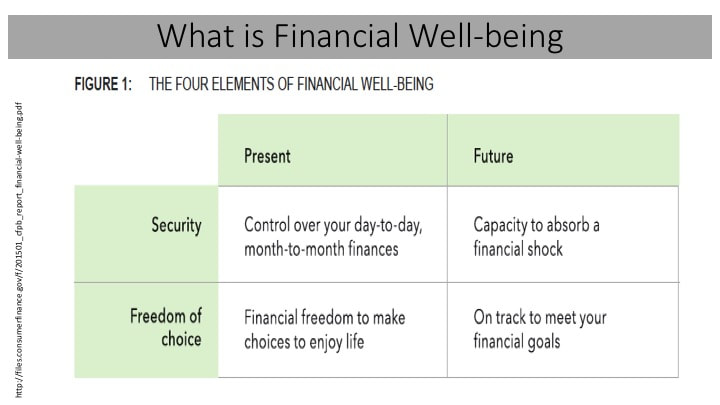

Consumers can experience financial well-being—or a lack of it—regardless of income. It’s a highly personal state, not fully described by objective financial measures. Instead, well-being is defined as having financial security and financial freedom of choice, in the present and in the future.

|

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed