Archives

May 2020

Categories

All

|

Back to Blog

What's on a credit report?

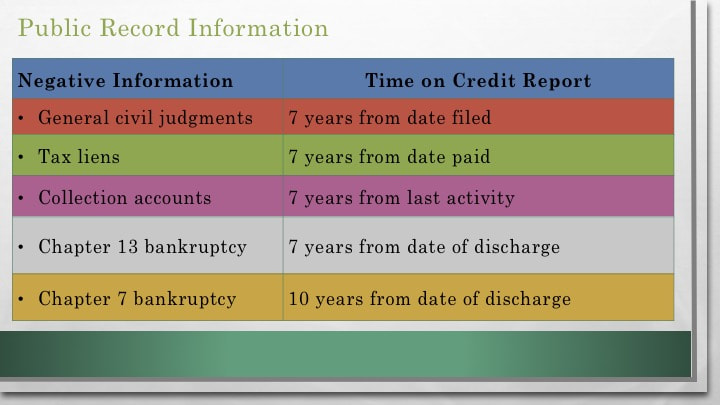

How Long Does Information Stay on a Credit Report?

The key is the "Date of Last Activity" (DLA.) The type of account is a factor also. Seven years from the DLA is the limit for most items other than a Chapter 7 bankruptcy (BK.)

Basic credit score improvement strategies

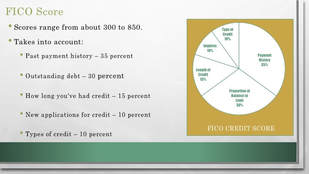

FICO Score Consumer Mortgage Model

Basic credit score improvement strategies

Trended Data Score Model This a newer method of determining your creditworthiness. How it impacts the financial services market is yet to be determined. It is a growing factor in mortgages. FHA, VA and other programs are using trended data now. •Pay credit card balances in full every month •Do everything required for FICO score model improvement

0 Comments

Read More

Your comment will be posted after it is approved.

Leave a Reply. |

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed