The mortality projections from the COVID-19 virus range from a low-ball, happy-talk 100,000 to an alarmist 2.8 million. That is a lot of death. The majority of Americans will have first-hand knowledge of someone in their social network who grieves for a COVID-19 casualty. Whatever the number, a lot of people will die from the pandemic. Their deaths will be added to the 2.8 million people who die annually in the United States.

Dead people leave estates. Everyone leaves an estate no matter how meager. For most working-class people, their estate consists of stuff and people. The people are your family and friends. Stuff is all you’ve accumulated in your life regardless of value. An estate plan gives you a final say. Planning for death isn’t widespread. A majority of Americans will die without an estate plan. The reasons are varied:

Some people superstitiously believe that planning for death brings it on quicker. Sooner or later does matter, but die you will. And dying without an estate plan from this pandemic or of natural causes in the next century will cause confusion and unnecessarily burden your family. The lack of an estate plan forces your family through the strain of the probate court.

The real purpose of an estate plan is to provide peace of mind and give you a sense of accomplishment. The majority of Americans desire an estate plan.

An estate plan is part of a MoneySmartLife. The COVID-19 pandemic reminds us of the need to get or update ours now. Admittedly, there is a knowledge gap when it comes to estate planning for most. You have to close your gap of knowledge on this. Informing yourself will help you help your family, friends, and yourself successfully deal with this fact of life during these times of high anxiety. Being informed will make your interactions with estate and financial planning professionals more fruitful.

The pandemic offers the opportunity to address estate planning with your social network. Parents should be especially aware of estate plans regarding minors. Unresolved custody issues can be extremely volatile and detrimental to relationships and finances. COVID-19’s virulent infectious nature requires those that die, must often die alone. There will be no bedside visits and last wishes. Discuss, then codify your desires with your family now. Once your estate plan is handled, encourage others in your social network to do the same. Everyone should have an estate plan, even more so the vulnerable during the COVID-19 pandemic. Although a necessary expenditure, the cost of having an estate plan prepared has been an impediment to some. In most cases, the advice and counsel of estate-planning attorneys and financial planners should be sought. But in this emergency, a simple online estate plan is better than no plan at all. Dying intestate can be catastrophic to your estate and final wishes. After you have your emergency online estate plan, resolve to keep it updated with the help of qualified professionals as the seasons in your life change. I am calling for free or heavily discounted simple estate plans from the top 8 best online will makers in 2020 during the pandemic. The estate plan would include a Last Will & Testament, Power of Attorney, and Living Wills. If Americans would create and update their estate plans, it will prevent an overwhelming surge of pandemic death cases to probate court dockets. Having an estate plan is a necessity for everyone. Shielding your loved ones and property from courts, taxes, wounding quarrels, etc. is your plan’s goal. Make one today. Don’t worry about it being perfect. It can be changed later. Regardless of age, create or update your estate plan now.

0 Comments

The coronavirus mitigation protocols have forced many people to stay indoors. Here are some tasks you can do to improve your financial situation during this time. These tasks are not for the financially desperate or food insecure. Instead, it is for those that have a level of sustainability at the beginning of the COVID-19 protocols. (Checkout 10 MoneySmartLife Coronavirus Strategies in a previous post on this site.) Here are the 7:

1. Work on that business plan. No longer will you have to serve your greedy corporate overlords. There will be opportunities after the coronavirus economic carnage is over for new businesses. Do the work on your plan now that you claimed you never had the time to do. Get serious about your dreams. Put them on paper. 2. Increase your cash on hand and limit your trips to ATMs. Money is always good to have available, especially during times of economic dislocation.

3. Move money to more secure liquid accounts. From certificates of deposit to a savings account or from a brokerage money market fund to an FDIC insured one. Interest rates are low across the board right now. So safety may be a more critical consideration than an incremental higher interest rate at this time. 4. Take your insurance game to the next level.

5. Organize your financial records.

6. Spend time daily, increasing your financial intelligence. Make a concerted effort to learn more about your money and the best ways to handle it.

7. Relax, don’t panic. There is no need to hoard items or cash out your 401(k). Things will be rough for a while, no doubt. But it will settle down. When it does, many opportunities will abound for those prepared to seize them. Make the best of this stay-in period for yourself, your family, and money by implementing the above ideas. You might not be able to do them all, but you can do some.

The coronavirus will impact your money and your life. Here are some smart things you can do now. These strategies will be useful for both the well and ill-prepared. The economic disruption caused by the response to the coronavirus pandemic will pass. Here are the MoneySmartLife things you can do now.

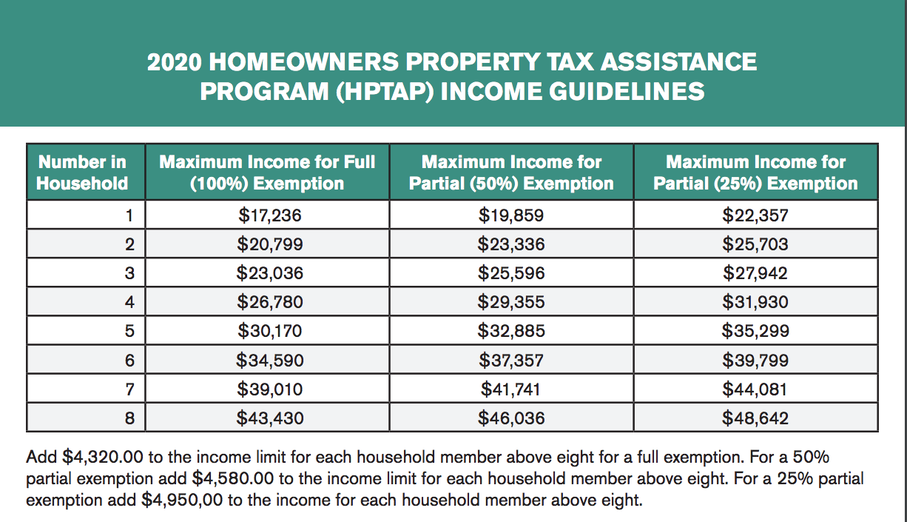

Low-income Detroit homeowners may get some relief from their ongoing tax injustice with the new Pay As You Stay (PAYS) program. Gov Whitmer signed the bill at the end of February that provided relief for qualifying taxpayers. The law starts now and sunsets in 2023. Participants in "Pay as You Stay" will get their interest and fees eliminated. And the remainder of their debt would be capped at 10% of their home's taxable value under the new law. You must be eligible for the Homeowners Property Tax Assistance Program to get PAYS. The application process can be found at the City of Detroit Pay-As-You-Stay webpage. Hopefully, the people that need to know about this program will find out about it in time. The city has a less than honorable history in property taxation. This new program doesn't address over-assessments past or present that criminally confiscated hundreds of family homes and blighted neighborhoods through tax foreclosures. |

Details

Archives

May 2020

Categories

All

|

Contact Us |

Necessary Disclaimers

|

RSS Feed

RSS Feed