Low-income Detroit homeowners may get some relief from their ongoing tax injustice with the new Pay As You Stay (PAYS) program. Gov Whitmer signed the bill at the end of February that provided relief for qualifying taxpayers. The law starts now and sunsets in 2023. Participants in "Pay as You Stay" will get their interest and fees eliminated. And the remainder of their debt would be capped at 10% of their home's taxable value under the new law. You must be eligible for the Homeowners Property Tax Assistance Program to get PAYS. The application process can be found at the City of Detroit Pay-As-You-Stay webpage. Hopefully, the people that need to know about this program will find out about it in time. The city has a less than honorable history in property taxation. This new program doesn't address over-assessments past or present that criminally confiscated hundreds of family homes and blighted neighborhoods through tax foreclosures.

0 Comments

12/15/2019 8 money tools available to most working-class people and how to use them effectivelyRead Now

Continuing Series on the 6 Financially Healthy Behaviors Often when it comes to money some of our behavior can subconsciously be influenced by our money habitudes or by one or more of the four external financial health influencers. This can result in frustration and missing your money goals. Money is like food in a lot of ways. It is something that we consume and is necessary to live. Just as improper behavior in relation to food leaves you in ill-health; an improper relationship with money can prevent financial well-being. Crash diets and get rich schemes may provide short-lived results but without a fundamental behavior change the results will not last. Here are 6 financially healthy behaviors working-class households can use in the journey to financial well-being. These 6 financially healthy behaviors will increase your financial capabilities and lower your money stress. In no particular order of importance, the first financially healthy behavior is “uses an effective range of financial tools.”  Ultimately the responsibility of learning how to manage money rest with the individual Ultimately the responsibility of learning how to manage money rest with the individual

Since hominids roamed the Rift valley into the plains of Africa, effective use of tools gives a person the ability to alter an environment for their benefit. That is true for your money environment also. Each household operates within a larger economy. That larger economy creates an environment ranging from wholesome to toxic that generates irresistible forces that impact households. Altering that environment for your benefit through the effective use of some financial tools will help you succeed in your financial evolution.

Credit cards are a necessary part of life in 21st century America. They can be a bane or a blessing depending on ownership. By that I mean, “Do you own your credit cards or do your credit cards own you?” A well-managed credit card can provide increased monthly cash flow and lifestyle enhancements through rewards and other cardholder benefits. Cash advances can also be used as part of a last resort safety net or emergency fund. Credit cards should be proactively managed for rewards, utilization ratios, and annual limit increases. Poorly managed credit cards lead to high-interest rate debt, stress, and a diminished lifestyle. This is like using a tool on yourself instead of on your circumstances. This is what happens to the undisciplined money managers and impulsive spenders. If this is your situation, there is hope. You don’t have to stay that way. Everyone engages with the economy through Financial Services. These services and products are sold by a variety of entities. Accessing these services requires both prudence and due diligence. Buyer beware! There are many “trick and trap” instruments promoted to the ill-informed and desperate. Loans of all types can have such terms: Payday, Title, Student, Mortgage, Auto, etc. Strategically accessing capital when you need it is a good thing. Of course self-funding, though not always possible, would be the best course. There is nothing wrong with borrowing. But do so when it is the only option left. Borrowing should never be your first option. Do you really need to borrow? What are the terms? Can you maintain the payments even if your income is reduced? Checking/Savings accounts are necessary to engage the economy. These deposit accounts give you access to cash and the ability to make payments. Your deposits are held securely until you access them through cash withdrawals, debit cards, wire transfers, or ATMs. Lack of access to these basic services has left many “unbanked” at the mercy of the unscrupulous and greedy. Those that do have access must be ever vigilant of fees and other balance reducing charges that are profit centers for some financial institutions. Continuous financial education must be a value that you fully embrace. Thanks to Google, YouTube, MoneySmartLife.org, and a plethora of financial websites and books you can always be informed about your money. Being informed will help you make better decisions and plan for success. You don’t have to be an Accountant per se, but you should be fluent enough to discuss your situation with one. Be aware when consuming financial information of its source and affiliations that may result in bias or steering. Look for objective sources of information like MoneySmartLife.org. This is not to say there isn’t great information on commercial sites. There most certainly is. Just be aware of whose paying the piper for the tune being played. Investments are assets you have above your living expenses and emergency fund. They generally have a long term purpose or goal such as capital appreciation or income. Whether you engage a Financial Advisor or decide to go it alone, the basics must always be satisfied. Those are your time horizon, risk tolerance, and the suitability of the investment. All three should be satisfied before you invest or engage an advisor. The main thing investments should do is put you on the positive side of the interest equation. Which side of the interest equation is more characteristic of your money; paying it or receiving it? Insurances are part of your risk management strategy and disaster recovery plan. Having appropriate coverages can help you offset a loss due to a covered event. Life, health, home, auto, business, renters insurance markets are highly competitive. This means you should regularly review your coverages and seek competitive quotes. Make sure whichever company you choose has a reputation for fairly paying claims. Money paid in taxes doesn’t contribute to your wealth. Therefore utilizing available Tax Shelters lets you keep more of your money. Shelters don’t have to be elaborate but simply available such as charitable contributions, self-employment expenses, 401(k), HSA, or mortgage deduction. Paying taxes contributes to the quality of life. It is the irrefutable responsibility of every person to pay some taxes. But you should not pay more than you owe. As an American, my attitude toward all forms of taxation is the same. Tax evasion is a crime. Aggressive tax avoidance is our patriotic duty. Since tax law frequently changes this should be a part of your continuing education. A Credit Score can be a tool. Maximize your credit score. Excellent credit (750++) will allow you to take advantage of sales incentives like sign and drive or 0% interest car loans. You will also get lower interest rates when you do borrow. Move your credit score up above 775 strategically and on purpose. Your ability to borrow should be viewed as part of your safety net. Your credit card cash advances and spending limits are criticalcomponents that can be managed to help mitigate some of the impacts of an emergency while buying you time. An excellent credit score can give you immediate access to additional money during an emergency. It is a MoneySmartLife strategy to responsibly and proactively expand your borrowing capacity annually. Just as your net worth expands annually so should your credit capacity. These 8 money tools are available to most working-class people. Know how to use them capably. The cliche applies, "it is a poor worker who blames the tool." The World Bank defines “Financial capability as the internal capacity to act in one's best financial interest, given socioeconomic environmental conditions. It, therefore, encompasses the knowledge, attitudes, skills, and behaviors of consumers with regard to managing their resources and understanding, selecting, and making use of financial services that fit their needs.” Ultimately the responsibility of learning how to manage money rests with the individual. If you think somebody cares more about your money than you do; you have another think coming. Effectively using all available money tools is on you.

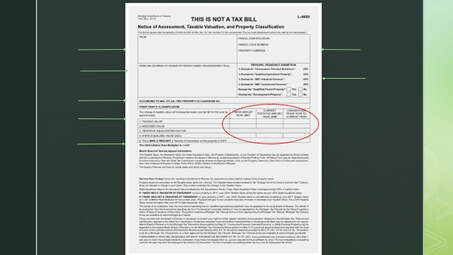

The window envelope comes from your Municipal Tax Assessor’s office. Your muscles tense. Your thoughts focus. Wasn’t the mortgage company suppose to handle property tax stuff? Who needs another bill. Your adrenaline has kicked in to help you face this “threat.” It sharpens your focus.

You nervously open the envelope. Its contents scream in large bold font across the top “THIS IS NOT A TAX BILL.” Relief washes over you as you put the notice down, one of the biggest mistakes that homeowners make. Because if you take the time to read and understand this form, you will reduce the amount of taxes you pay on your home for years.

Homeowners in their first year of ownership should pay particular attention. If this is the first year owning your home, then one of the most important things you can do is to make sure that your property is assessed correctly in the first year of ownership. Transfer of Ownership is a significant taxable event in Michigan. Transfer of Ownership includes not only purchases but inheritance, divorce, probate, etc.

Ignoring this can cost you thousands of dollars over the life of your homeownership. The first year of ownership is the only time your state equalized value (SEV) will be the same as your taxable value. The reset of SEV and taxable value can substantially raise a new homeowner’s property taxes during the first two years. That is called the “pop-up tax.” You want your taxable value to start as low as possible. The only way to get it done is to appeal your property tax assessment. The good news is that it’s not hard to do. Since you just bought the house, you probably have all the documentation you need to make a strong appeal. 11/25/2017 Detroit Homeowners plundered by fraudulent property tax assessments since 2008 part 1Read Now

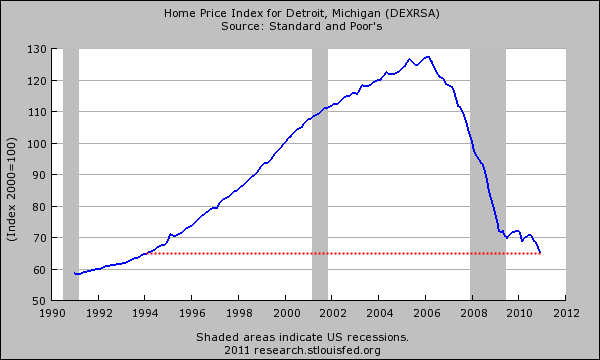

The Detroit city government fraudulently overtaxed Detroit property owners during the Kilpatrick, Cockrel, Bing, and Duggan administrations. The resulting tax delinquency foreclosures led it to the systematic dispossession of Detroit homeowners by the government. The burden was disproportionately borne by those whose properties had lower values and could least afford it.

At the height of the recent economic crisis, Detroit assessed residential properties at market values that did not reflect what was happening to Detroit’s real estate. Valuations for tax purposes were going up. In reality, property values were going down, fast and hard. The city government systematically inflated the property tax assessments of homes in Detroit beyond the legal limit.

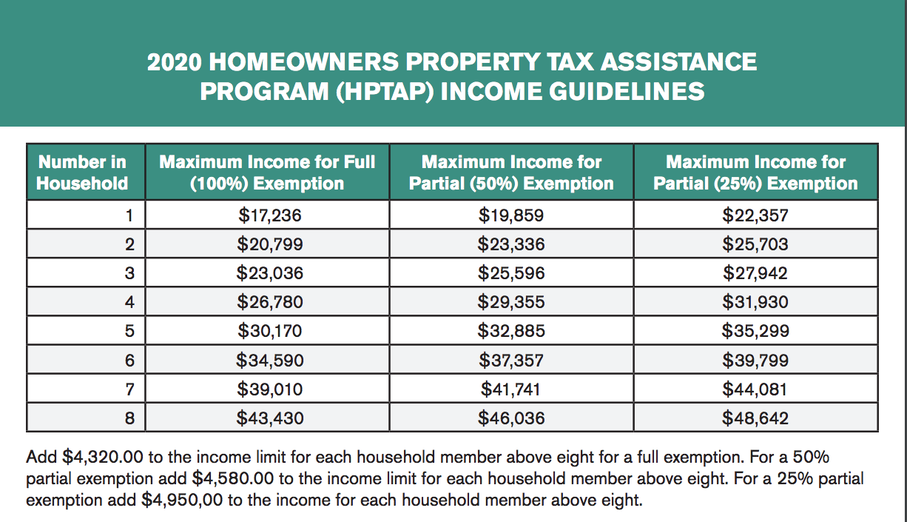

Starting in 2008, home values in Detroit plummeted as a result of the Great Recession. Instead of reducing property tax assessments to match the lower cost of homes, the government maintained the previous higher assessed value. The Michigan Constitution sets property assessments at no more than 50% of market value. That value is known as the State Equalized Value or SEV.

|

Details

Archives

May 2020

Categories

All

|

Contact Us |

Necessary Disclaimers

|

RSS Feed

RSS Feed