Archives

May 2020

Categories

All

|

Back to Blog

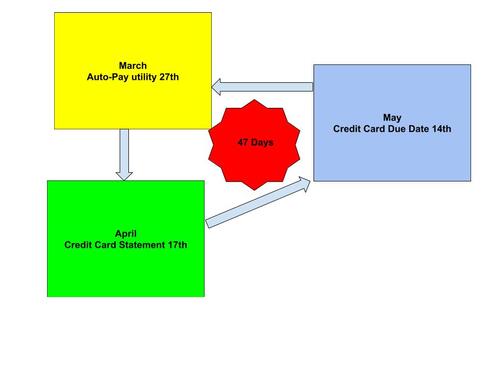

There is a way to keep your money longer by using credit cards and autopay. I have been using this strategy successfully for several years. It has evened out my cash flow and put cash and rewards in my pocket. This strategy is only valid if you pay your credit card statement balance in full every month. Here how it works. DATES are important. You need credit cards with different closing dates throughout the month. Credit card transactions are billed at set times called billing cycles. The last day of the billing cycle is the account statement closing date. The due date is the date by which you must pay your credit card statement balance. There is a grace period between the statement closing date and the payment due date. By law, the credit card company is required to offer a grace period of at least 21 days. This is the time from your statement closing date you get to make a payment before interest is charged on new purchases. That is 21 more days to keep your money. The credit cards I use:

All transactions since the last closing date will be included in your credit card statement. Credit card transactions are billed at set times called billing cycles. The last day of the billing cycle is the account statement closing date. You have a grace period between the statement closing date and the payment due date that’s roughly between 21 and 25 days, depending on the card you have. Your card has a grace period, The credit card company is legally required to offer a grace period of at least 21 days. This the time from when you get your statement to make a payment before interest is charged on new purchases.

I use this strategy with reward credit cards for cash back or travel rewards to help maximize the benefits. I love accumulating miles from paying for utilities. I use the same strategy for cell phones, cable/internet, streaming subscriptions, and natural gas. If you actually deposit the deferred payments into an interest-bearing account, you may even see a modest gain over a year. Other considerations Monitor your credit card statements carefully. Auto-pay amounts may change. I do not auto-pay my credit cards. This forces me to interact with the website to pay the bill. Therefore I get to monitor my statement before I make my payments. Using this strategy will allow you to pay your bills on time and keep your money longer while doing it.

0 Comments

Read More

Back to Blog

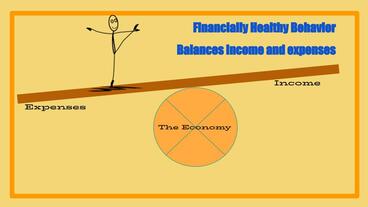

The next financially healthy behavior in our series is “balances income and expenses.” Balance is a state of being. We strive to achieve balance in life. When it comes to money, there is much to balance. Wants vs. needs; long-term goals and short-term goals; security vs. risk-reward; retirement savings vs. spend now; debt service and discretionary income; etc. Imagine yourself standing in the middle of a long plank balanced on a large ball. One side is expenses, and the other is income. Your spending choices and realized income opportunities determine how much is added to each side of the plank. The ball represents macro-economic factors that may change. Your goal is to maintain balance. Maintaining your balance requires constant motion. Balance doesn’t necessarily need equilibrium to be successful. Maintaining balance involves attentiveness to details and mini-corrections. Add some to one side or take from the other. Repeat as necessary. The sides of the plank are not equally weighted. The expense side of the plank is weighted from birth. Humans are an expense from birth to economic viability. Economic viability is when a person is contributing more in value than they are consuming in resources. This even applies to trust fund babies. But they also come with a preloaded income side. It is easier to maintain balance than it is to achieve it initially. From birth, most working-class families, especially the legacy dispossessed, are crawling up the expense side of the plank trying to attain balance. Unfortunately, they must make that journey through a hostile environment. One filled with “trick and trap” financial services (payday loans), targeted economic disinformation (debt consolidation), and the need to make sophisticated financial and investment decisions (401k). Many are ill-equipped to do so. The financially ill-informed are the prey of financial services predatory capitalists. “Experience is a hard teacher because she gives the test first, the lesson afterward.” Vernon Law. Trial and error is not an option for most. Recovery is often not easy from such money lessons that extract resources from the already low-resourced, which could also lead to foreclosure or bankruptcy. Additionally, there are extended periods of imposed financial purgatory, effectively barring access to other products and services. These higher standards and lower limits for future borrowing are imposed over a lifetime. The reason there are no non-white Walt Disney or Donald Trump is non-whites don’t get the chance to have multiple bankruptcies. It is one and done. Win or go home. Rather win or lose your home. Here are some things to help you balance income and expenses: MAXIMIZE INCOME

Back to Blog

Income & Expense Volatility Income & Expense Volatility

One of the four financial health influencers is the volatility of income and expenses. Households impacted by such volatility find it difficult to achieve financial well-being. Increased expenses or reduced income often dictate tough lifestyle choices and increase stress levels beyond chronic. When there is increased income or reduced expenses, there is a less problematic increase in household discretionary funds and the fun that goes with it. Seasonal workers, those on fixed incomes, or subject to inconsistent hourly work schedules are especially vulnerable to this type of volatility.

These financial shocks can have a devastating effect. Income and expense volatility does not have to impede your pursuit of 6 Financially Healthy Behaviors. Volatility can be mitigated by preparing for it. John F. Kennedy once said, “The time to repair the roof is when the sun is shining.” Please don’t wait for it to rain before you prepare. One cause of volatility is “stuff happens.” Happens to everybody. No one is immune. To achieve financial well-being, you need to possess the “capacity to absorb financial shocks.” Economic setbacks can be self-inflicted or come from external sources. The future economy will be disrupted by geopolitical, weather, or cyberattack events. It is essential to be able to manage and recover from the inevitable financial shocks. Every household should have a disaster recovery plan. The foundation of a financial recovery plan is the Emergency Fund, the “liquidity buffer” between you and ruin. Building an emergency fund is your #1 priority, no matter your age. You should well establish an emergency fund before you divert resources to a debt reduction strategy. Emergency funds are highly individualized. Sufficiency depends on a variety of factors, including your health, your age, your temperament, dependents, housing situation, the stability of your job, your risk tolerance, and more. Just be mindful of the truism, “It’s better to have money and not need it; than to need it and not have it.” Your emergency fund can’t be too big. Its size may determine how it is stored but not its existence. 4 Ways to Jumpstart an Emergency Fund

Being able to deal with income and expense volatility successfully requires preparation. The base of that preparation is an emergency fund. Start or grow yours now. |

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed