Archives

May 2020

Categories

All

|

Back to Blog

Where are you on the COVID-19 Pandemic Financial Experience Scale? Working-class people are experiencing this pandemic very differently financially. There are 3 benchmarks on the scale. This is a look at the second benchmark, "Treading."

TREADING MODE For you, the crisis is disruptive but not destructive. You have some reserves and a safety net. You are experiencing diminished income. You can maintain most of your lifestyle with a combination of reduction of non-essential expenses and subsidies from your stockpiles of food and finances. There are finite amounts of those resources available. Here are some tactics you can use to help you maintain the status quo for a while.

Credit card forbearances can be tricky. It's all about the interest and how it reports to the credit bureaus. I've heard of some very generous terms. ‘Current balance held at no interest until paid in full as serviced by a minimum payment.’ It is also reported to the credit bureaus as "paid as agreed." If you currently have a statement balance that amounts to an interest-free loan instead of the legally usurious interest rates credit cards charge now. Double-check to see if the terms apply to cash advance balances also. Often you "voluntarily" agree not to use the credit card during the forbearance period. If your credit servicer is not offering generous terms, make your minimum monthly payment during the pandemic. (If you are unable to make your minimum monthly payments, you are in Surviving mode.) Keeping your word is paramount in this situation. Do not make commitments you can't keep. You may have to go back to your creditors for additional relief. Broken payment promises may make them less likely to provide help.

0 Comments

Read More

Back to Blog

Where are you on the COVID-19 Pandemic Financial Experience Scale? Working-class people are experiencing this pandemic very differently financially. There are 3 benchmarks on the scale. This is a look at the first benchmark, "Surviving."

SURVIVING MODE This crisis caught you unprepared. You have limited resources anda fragile safety net. Your income is gone. Your lifestyle is in jeopardy. Your standard of living is diminished. You have done all you know to do. The stress and pressure are negatively affecting you, physically and emotionally. You’ve gone from making savings and debt reduction decisions to housing and food insecurity. Your financial focus (time, talent, and treasure) has shifted from working on longer-term goals to money shortage problem-solving. You see very little if any light at the end of the tunnel. Your future looks bleak. You need a miracle. So, position yourself for one. Here is how to activate the power of God in your financial life, on purpose. Become a hardcore, no turning back, tither of your gross income. Tithing is a covenant between you and God. It is a contract that He offered. It is a lot like those “terms of use” agreements we get when we download a new app. It is pretty much, “take it or leave it.” If you don’t agree, you won’t get the benefits of the app. To get the benefits of tithing, you must sign the agreement. You do that by making a commitment to tithe. Then demonstrate that commitment by your future behavior. If you do that, God promises to meet all your needs. The context of this promise is to individuals who had not tithed in the past, like you. Despite that, they were offered a fresh start. That is true for you also. Grace and Mercy will overcome your guilt and history financially. The point is to start and don’t stop. It is controversial whether the tithe applies to the New Testament dispensation. It is not controversial to me. When I made my commitment to tithe, “I was so broke I couldn’t pay attention.” My conversation with God went like this. “Okay, Lord, You said if I tithed, You would bless me and mine. If You bless me, I’ll go tell it. And if You don’t bless me, I’ll go tell that too.” That was not a threat to God but rather a promise to give Him a Yelp review. That was about 4 decades ago, and I have never looked back or regretted the decision. “Five stars, Outstanding customer service.” “Blessed” means different things to different people. Here are some of the elements I consider when I say, “I’m blessed.”

Get your eyes off the promise and turn them toward the Promise Keeper. Now that you have started tithing, you rightfully expect a return. However, tithing is not an investment. Your focus should not be on the timing and size of the promised return. Instead, your focus should be on pleasing God. Remember, He provides daily. Be wary of those who preach to your desperation and not to your faith. Tithing requires you to give your money away. Where you give your money is important. Because of the prevalence of “prosperity preachers and famine feeders” making appeals, the tithing message can be easily distorted to appeal to your need. Give to them, and you will receive, you are told. That appeals to your need. You don’t give to get, no matter how great your need. You give to honor God. Your motive is just as important as your behavior. When you give, be sure it is for the right reason and not because of a compelling appeal. Miraculously changing your financial life requires a change in behavior. Behavior changes are not easy. Changes of behavior require commitment. Commitment is demonstrated by behavior. Tithing is a behavior. And just like with exercise and oral hygiene, consistency is what brings long-term results. The COVID-19 pandemic has forced you into a desperate situation. Your options are few and dwindling. Your situation seems beyond your capacity to solve. You need a miracle. Position yourself for a lifetime of miraculous provisions by being a hardcore tither. What have you got to lose? You don’t have enough to make it now, anyhow, right? Honor God with your tithe and experience His provision and more. True, you don't have to be a tither to be blessed by God. However, I have never seen a tither not blessed by God. No, not one.

Back to Blog

The coronavirus mitigation protocols have forced many people to stay indoors. Here are some tasks you can do to improve your financial situation during this time. These tasks are not for the financially desperate or food insecure. Instead, it is for those that have a level of sustainability at the beginning of the COVID-19 protocols. (Checkout 10 MoneySmartLife Coronavirus Strategies in a previous post on this site.) Here are the 7:

1. Work on that business plan. No longer will you have to serve your greedy corporate overlords. There will be opportunities after the coronavirus economic carnage is over for new businesses. Do the work on your plan now that you claimed you never had the time to do. Get serious about your dreams. Put them on paper. 2. Increase your cash on hand and limit your trips to ATMs. Money is always good to have available, especially during times of economic dislocation.

3. Move money to more secure liquid accounts. From certificates of deposit to a savings account or from a brokerage money market fund to an FDIC insured one. Interest rates are low across the board right now. So safety may be a more critical consideration than an incremental higher interest rate at this time. 4. Take your insurance game to the next level.

5. Organize your financial records.

6. Spend time daily, increasing your financial intelligence. Make a concerted effort to learn more about your money and the best ways to handle it.

7. Relax, don’t panic. There is no need to hoard items or cash out your 401(k). Things will be rough for a while, no doubt. But it will settle down. When it does, many opportunities will abound for those prepared to seize them. Make the best of this stay-in period for yourself, your family, and money by implementing the above ideas. You might not be able to do them all, but you can do some.

Back to Blog

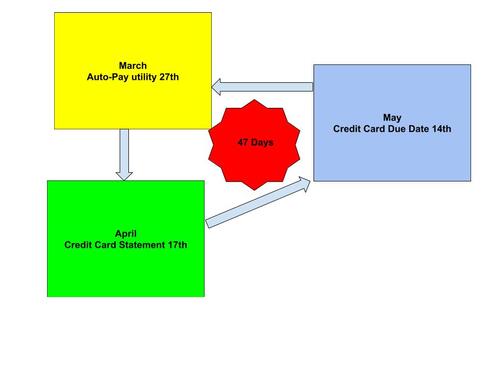

There is a way to keep your money longer by using credit cards and autopay. I have been using this strategy successfully for several years. It has evened out my cash flow and put cash and rewards in my pocket. This strategy is only valid if you pay your credit card statement balance in full every month. Here how it works. DATES are important. You need credit cards with different closing dates throughout the month. Credit card transactions are billed at set times called billing cycles. The last day of the billing cycle is the account statement closing date. The due date is the date by which you must pay your credit card statement balance. There is a grace period between the statement closing date and the payment due date. By law, the credit card company is required to offer a grace period of at least 21 days. This is the time from your statement closing date you get to make a payment before interest is charged on new purchases. That is 21 more days to keep your money. The credit cards I use:

All transactions since the last closing date will be included in your credit card statement. Credit card transactions are billed at set times called billing cycles. The last day of the billing cycle is the account statement closing date. You have a grace period between the statement closing date and the payment due date that’s roughly between 21 and 25 days, depending on the card you have. Your card has a grace period, The credit card company is legally required to offer a grace period of at least 21 days. This the time from when you get your statement to make a payment before interest is charged on new purchases.

I use this strategy with reward credit cards for cash back or travel rewards to help maximize the benefits. I love accumulating miles from paying for utilities. I use the same strategy for cell phones, cable/internet, streaming subscriptions, and natural gas. If you actually deposit the deferred payments into an interest-bearing account, you may even see a modest gain over a year. Other considerations Monitor your credit card statements carefully. Auto-pay amounts may change. I do not auto-pay my credit cards. This forces me to interact with the website to pay the bill. Therefore I get to monitor my statement before I make my payments. Using this strategy will allow you to pay your bills on time and keep your money longer while doing it.

Back to Blog

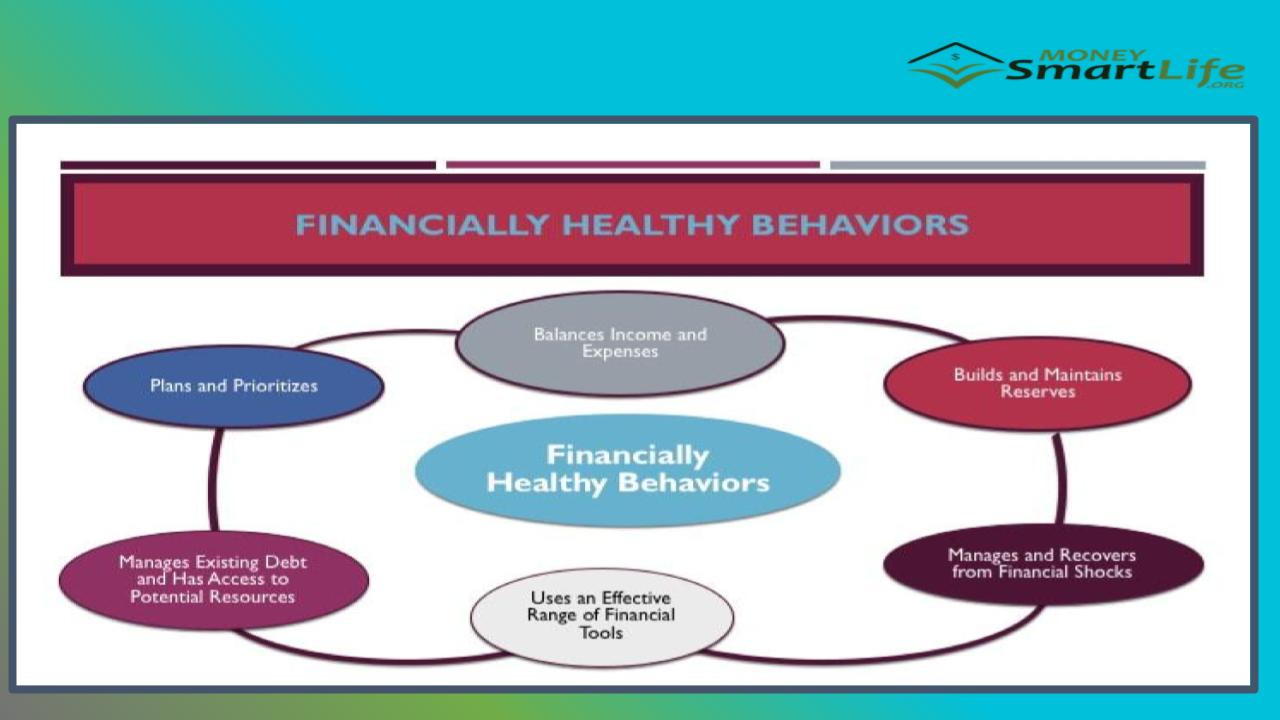

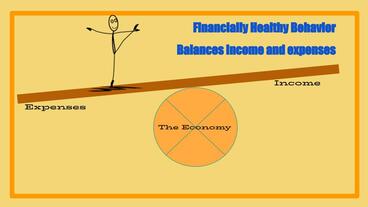

The next financially healthy behavior in our series is “balances income and expenses.” Balance is a state of being. We strive to achieve balance in life. When it comes to money, there is much to balance. Wants vs. needs; long-term goals and short-term goals; security vs. risk-reward; retirement savings vs. spend now; debt service and discretionary income; etc. Imagine yourself standing in the middle of a long plank balanced on a large ball. One side is expenses, and the other is income. Your spending choices and realized income opportunities determine how much is added to each side of the plank. The ball represents macro-economic factors that may change. Your goal is to maintain balance. Maintaining your balance requires constant motion. Balance doesn’t necessarily need equilibrium to be successful. Maintaining balance involves attentiveness to details and mini-corrections. Add some to one side or take from the other. Repeat as necessary. The sides of the plank are not equally weighted. The expense side of the plank is weighted from birth. Humans are an expense from birth to economic viability. Economic viability is when a person is contributing more in value than they are consuming in resources. This even applies to trust fund babies. But they also come with a preloaded income side. It is easier to maintain balance than it is to achieve it initially. From birth, most working-class families, especially the legacy dispossessed, are crawling up the expense side of the plank trying to attain balance. Unfortunately, they must make that journey through a hostile environment. One filled with “trick and trap” financial services (payday loans), targeted economic disinformation (debt consolidation), and the need to make sophisticated financial and investment decisions (401k). Many are ill-equipped to do so. The financially ill-informed are the prey of financial services predatory capitalists. “Experience is a hard teacher because she gives the test first, the lesson afterward.” Vernon Law. Trial and error is not an option for most. Recovery is often not easy from such money lessons that extract resources from the already low-resourced, which could also lead to foreclosure or bankruptcy. Additionally, there are extended periods of imposed financial purgatory, effectively barring access to other products and services. These higher standards and lower limits for future borrowing are imposed over a lifetime. The reason there are no non-white Walt Disney or Donald Trump is non-whites don’t get the chance to have multiple bankruptcies. It is one and done. Win or go home. Rather win or lose your home. Here are some things to help you balance income and expenses: MAXIMIZE INCOME

|

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed