Archives

May 2020

Categories

All

|

Back to Blog

Financial Well-Being Matrix Financial Well-Being Matrix

Recently the weather gave us notice that Nature was about to bring about a season change. Like it or not, ready or not the seasons will change. According to wise King Solomon in Ecclesiastes, everything under heaven has a season.That would include the American and global economies. And importantly, seasons change.

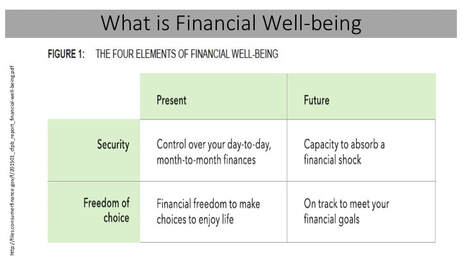

The economy's season is changing. Possible recession, the impact of tariffs on prices, and stagnant wage growth. In the words from HBO's Game of Thrones, "Winter is coming." Part of financial well-being is "the capacity to absorb a financial shock." The key is your CAPACITY. Here are four strategies to do now to increase your capacity.

check out ways to save money this week on our FB feed

0 Comments

Read More

Back to Blog

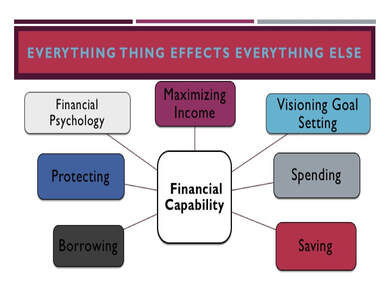

Okay the BK is discharged. Now let's start rebuilding your credit score. This not a quick fix. It also assumes you have effectively dealt with whatever caused you declare bankruptcy whether it be situation, lifestyle, or lack of financial capabilities.

This strategy is front-loaded with a long term payoff because of the BK credit restoration timeline. A BK can be on your credit report for up to 10 years. The good news is that its impact lessens on your credit report the further removed it is from the present. You may be eligible for a mortgage or auto loan in much less time if your other factors are strong. Here are the six steps to rebuild a perfect credit score: 1.Be wary of credit repair companies.

2. Start now. Be patient.

4. Check your credit reports 90 days after BK and then at least annually thereafter.

Back to Blog

Credit diversity or “types of accounts,” in credit report speak, is a minor factor that determines about 10% of your credit score in most scoring models.

It measures how you have handled different types of credit accounts, currently and over time. Since it is measured by the scoring models, it also can be managed or influenced by you. Like most things related to credit scores, it is best accomplished over time and with a strategy. There are three types of accounts credit scoring algorithms consider:

What Is NOT Part of Credit Mix?

Best practices to optimize credit diversity

Back to Blog

Inquiries are required by law to be on your credit report for 2 years. Inquiries are only about 10% of your credit score. Because it can impact your credit score you still need to manage it to optimize your score. Especially if you are now or will be actively looking for credit in the near future. Types of inquiries are described by the industry jargon of "hard" and "soft." Soft inquiry

|

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed