Archives

May 2020

Categories

All

|

Back to Blog

The coronavirus mitigation protocols have forced many people to stay indoors. Here are some tasks you can do to improve your financial situation during this time. These tasks are not for the financially desperate or food insecure. Instead, it is for those that have a level of sustainability at the beginning of the COVID-19 protocols. (Checkout 10 MoneySmartLife Coronavirus Strategies in a previous post on this site.) Here are the 7:

1. Work on that business plan. No longer will you have to serve your greedy corporate overlords. There will be opportunities after the coronavirus economic carnage is over for new businesses. Do the work on your plan now that you claimed you never had the time to do. Get serious about your dreams. Put them on paper. 2. Increase your cash on hand and limit your trips to ATMs. Money is always good to have available, especially during times of economic dislocation.

3. Move money to more secure liquid accounts. From certificates of deposit to a savings account or from a brokerage money market fund to an FDIC insured one. Interest rates are low across the board right now. So safety may be a more critical consideration than an incremental higher interest rate at this time. 4. Take your insurance game to the next level.

5. Organize your financial records.

6. Spend time daily, increasing your financial intelligence. Make a concerted effort to learn more about your money and the best ways to handle it.

7. Relax, don’t panic. There is no need to hoard items or cash out your 401(k). Things will be rough for a while, no doubt. But it will settle down. When it does, many opportunities will abound for those prepared to seize them. Make the best of this stay-in period for yourself, your family, and money by implementing the above ideas. You might not be able to do them all, but you can do some.

0 Comments

Read More

Back to Blog

10 MoneySmartLife Coronavirus Strategies3/16/2020

The coronavirus will impact your money and your life. Here are some smart things you can do now. These strategies will be useful for both the well and ill-prepared. The economic disruption caused by the response to the coronavirus pandemic will pass. Here are the MoneySmartLife things you can do now.

Back to Blog

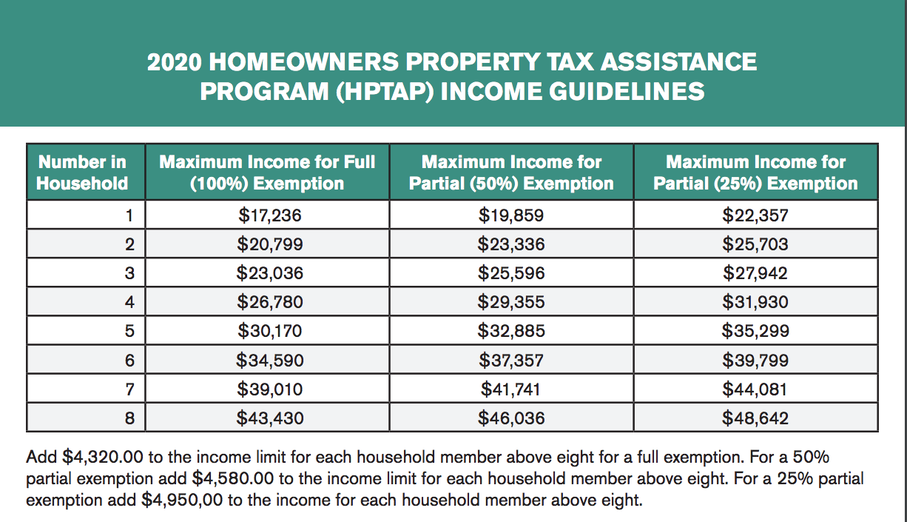

Pay As You Stay Property Tax Program3/3/2020  Low-income Detroit homeowners may get some relief from their ongoing tax injustice with the new Pay As You Stay (PAYS) program. Gov Whitmer signed the bill at the end of February that provided relief for qualifying taxpayers. The law starts now and sunsets in 2023. Participants in "Pay as You Stay" will get their interest and fees eliminated. And the remainder of their debt would be capped at 10% of their home's taxable value under the new law. You must be eligible for the Homeowners Property Tax Assistance Program to get PAYS. The application process can be found at the City of Detroit Pay-As-You-Stay webpage. Hopefully, the people that need to know about this program will find out about it in time. The city has a less than honorable history in property taxation. This new program doesn't address over-assessments past or present that criminally confiscated hundreds of family homes and blighted neighborhoods through tax foreclosures.

Back to Blog

Your behavior is one crucial factor that determines your financial well-being. It is not just what you know to do, but what you actually do that counts. Knowing you must save for retirement is different than saving for retirement. Knowledge should inform behavior not to be a substitute for it.

The next behavior in our look at six financially healthy behaviors is managing existing debt and has access to potential resources. This is your skills and ability to control your debt. And your capacity to generate outside resources in times of need. Let’s take a look at each. Manages Existing Debts

Back to Blog

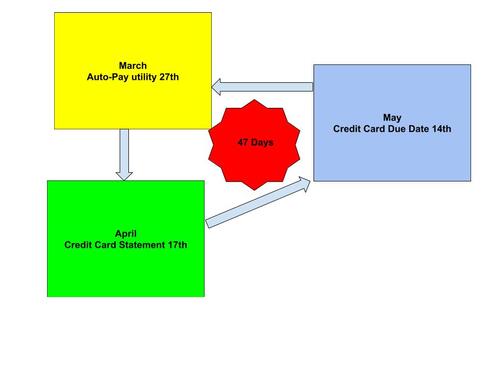

There is a way to keep your money longer by using credit cards and autopay. I have been using this strategy successfully for several years. It has evened out my cash flow and put cash and rewards in my pocket. This strategy is only valid if you pay your credit card statement balance in full every month. Here how it works. DATES are important. You need credit cards with different closing dates throughout the month. Credit card transactions are billed at set times called billing cycles. The last day of the billing cycle is the account statement closing date. The due date is the date by which you must pay your credit card statement balance. There is a grace period between the statement closing date and the payment due date. By law, the credit card company is required to offer a grace period of at least 21 days. This is the time from your statement closing date you get to make a payment before interest is charged on new purchases. That is 21 more days to keep your money. The credit cards I use:

All transactions since the last closing date will be included in your credit card statement. Credit card transactions are billed at set times called billing cycles. The last day of the billing cycle is the account statement closing date. You have a grace period between the statement closing date and the payment due date that’s roughly between 21 and 25 days, depending on the card you have. Your card has a grace period, The credit card company is legally required to offer a grace period of at least 21 days. This the time from when you get your statement to make a payment before interest is charged on new purchases.

I use this strategy with reward credit cards for cash back or travel rewards to help maximize the benefits. I love accumulating miles from paying for utilities. I use the same strategy for cell phones, cable/internet, streaming subscriptions, and natural gas. If you actually deposit the deferred payments into an interest-bearing account, you may even see a modest gain over a year. Other considerations Monitor your credit card statements carefully. Auto-pay amounts may change. I do not auto-pay my credit cards. This forces me to interact with the website to pay the bill. Therefore I get to monitor my statement before I make my payments. Using this strategy will allow you to pay your bills on time and keep your money longer while doing it. |

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed