Archives

May 2020

Categories

All

|

Back to Blog

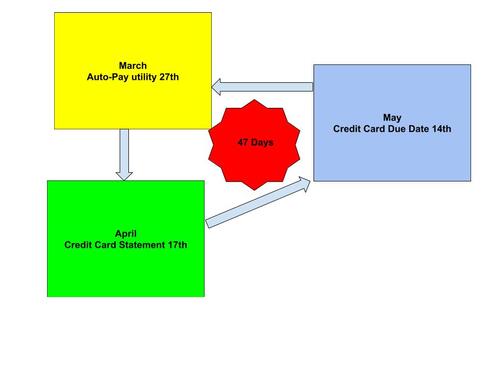

There is a way to keep your money longer by using credit cards and autopay. I have been using this strategy successfully for several years. It has evened out my cash flow and put cash and rewards in my pocket. This strategy is only valid if you pay your credit card statement balance in full every month. Here how it works. DATES are important. You need credit cards with different closing dates throughout the month. Credit card transactions are billed at set times called billing cycles. The last day of the billing cycle is the account statement closing date. The due date is the date by which you must pay your credit card statement balance. There is a grace period between the statement closing date and the payment due date. By law, the credit card company is required to offer a grace period of at least 21 days. This is the time from your statement closing date you get to make a payment before interest is charged on new purchases. That is 21 more days to keep your money. The credit cards I use:

All transactions since the last closing date will be included in your credit card statement. Credit card transactions are billed at set times called billing cycles. The last day of the billing cycle is the account statement closing date. You have a grace period between the statement closing date and the payment due date that’s roughly between 21 and 25 days, depending on the card you have. Your card has a grace period, The credit card company is legally required to offer a grace period of at least 21 days. This the time from when you get your statement to make a payment before interest is charged on new purchases.

I use this strategy with reward credit cards for cash back or travel rewards to help maximize the benefits. I love accumulating miles from paying for utilities. I use the same strategy for cell phones, cable/internet, streaming subscriptions, and natural gas. If you actually deposit the deferred payments into an interest-bearing account, you may even see a modest gain over a year. Other considerations Monitor your credit card statements carefully. Auto-pay amounts may change. I do not auto-pay my credit cards. This forces me to interact with the website to pay the bill. Therefore I get to monitor my statement before I make my payments. Using this strategy will allow you to pay your bills on time and keep your money longer while doing it.

0 Comments

Read More

Your comment will be posted after it is approved.

Leave a Reply. |

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed