Archives

May 2020

Categories

All

|

Back to Blog

The Detroit city government fraudulently overtaxed Detroit property owners during the Kilpatrick, Cockrel, Bing, and Duggan administrations. The resulting tax delinquency foreclosures led it to the systematic dispossession of Detroit homeowners by the government. The burden was disproportionately borne by those whose properties had lower values and could least afford it.

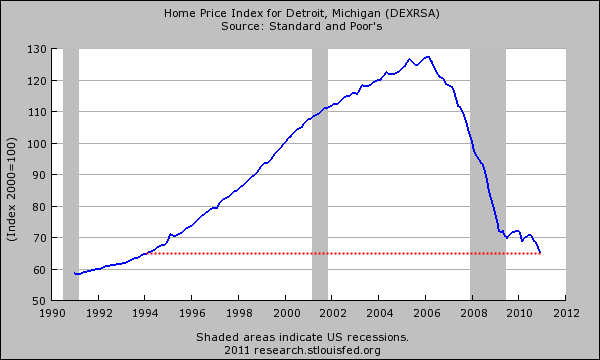

At the height of the recent economic crisis, Detroit assessed residential properties at market values that did not reflect what was happening to Detroit’s real estate. Valuations for tax purposes were going up. In reality, property values were going down, fast and hard. The city government systematically inflated the property tax assessments of homes in Detroit beyond the legal limit.

Starting in 2008, home values in Detroit plummeted as a result of the Great Recession. Instead of reducing property tax assessments to match the lower cost of homes, the government maintained the previous higher assessed value. The Michigan Constitution sets property assessments at no more than 50% of market value. That value is known as the State Equalized Value or SEV.

The art and science of property valuation are challenging, especially during times of rapid value deflation. There is the inherent tension that to do so would only lower already scarce municipal revenues. That was the reality for governments throughout metro-Detroit and Michigan.

There was no incentive for the city to assess property values accurately, especially below the current taxable value. The city assessor’s office was overwhelmed, understaffed, underfunded, and unable to carry out its constitutionally mandated duties. They did the best they could under the circumstance. The twin Category 5 storms of deep recession and a lack of good governance also hit the city about that time. The result was the city failed to meet its statutory responsibilities to assess property value at SEV. Each year between 2009 and 2015, unconstitutionally assessed 55% to 85% of Detroit properties, resulting in illegally inflated taxes on those properties. The government’s land grab provided much-needed cash leading up to the bankruptcy. There were decisions made every year to raise property valuations in the face of universal contradictory evidence. Everyone in the city government knew property values were falling. Those decisions were fraudulent and resulted in thousands of Detroiters losing their homes.

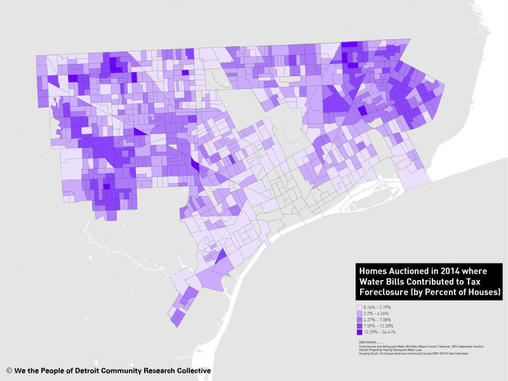

The scale of the expropriation was massive. In 2015 alone, taxing authorities sent 62,000 tax foreclosure notices in Detroit. There were over 18,000 occupied homes foreclosed.

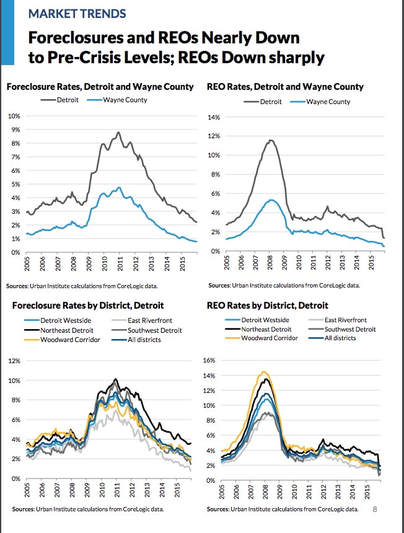

The property tax foreclosure crisis in Detroit has wiped out entire neighborhoods. From 2011 to 2015, the Wayne County Treasurer foreclosed upon about one in four Detroit properties for non-payment of property taxes. Illegal Robo-signed and legal mortgage foreclosures were at crisis levels during this time also. Since foreclosed properties were left vacant, many vandalized and stripped of everything of value. Derelict properties lowered neighborhood property values. Anyone who could get out; did so. Many neighborhoods are still unmortgageable because of low valuations.

The recession battered, poor, and working-class, black families lived in those homes. No surprise that residents weren’t able to pay. And it should not have happened. Many would have qualified for the city’s hardship property tax exemption. But Detroit didn’t publicize this, and the application process was difficult and nearly impossible to complete.

Detroit reduced property tax assessments under Duggan three years in a row. The property tax relief started neighborhood-specific and has become universal throughout the years. By doing so, the city admits to years of overassessment. It required an intervention for it to happen. In 2014, a three-member commission of the Michigan Tax Commission took control over property reappraisals in Detroit because of ‘mismanagement in Detroit’s Assessment Division.’ Citing ‘widespread over-assessments and rampant tax delinquencies.’ The commission put in a corrective action plan overhauling the property assessment and tax collection processes. They relinquished control to Detroit in August 2017. Michael J. Steinberg, legal director of the American Civil Liberties Union of Michigan, commended Duggan for making reductions but said they don’t go far enough. “It is too little too late for many people who have been overcharged,” Steinberg said. “I strongly urge everybody in the city of Detroit to appeal their taxes because it is undisputed they are unrealistic, and the values of the homes are overassessed.” Amen! Doing so should be an annual early Spring ritual for every Detroit homeowner. Michele Oberholtzer, the founder of Tricycle Collective, a city-based nonprofit that works to keep families in homes, said the accuracy of assessments in Detroit is improving, but bigger issues remain. “In my line of work, it’s cold comfort,” she said. “It’s wonderful that we’re seeing these assessments corrected, but it does not resolve the most detrimental impacts of the wrong assessment, which is tax foreclosure.”

The homeowners who lost their homes share responsibility for their dispossession. They are not to blame them for the economic hardships that befell them due to macroeconomic forces and corrupt governance. They were personally responsible for learning about hardship exemptions, appeal their tax assessment, and show financial capability.

Help was available. It required tenacious perseverance to access it. It was a lot harder to get than it should have been, but it was there. All who pro-actively reached out to housing counseling agencies received help. Housing counseling agencies have been successful in helping homeowners keep their homes. During this time, there were engaged MSHDA and HUD-certified housing counseling agencies in Detroit. Though not funded commensurate with the crisis, they delivered pragmatic solutions to their clients. Overlooking this resource was catastrophic for all the stakeholders. A DLBA buyback program graduated with 80 former displaced homeowners. At the time, I worked for a housing counseling agency and saw the process up close and personal. Central Detroit Christian did 38 of the 80 graduates. Every one of them a bureaucratic struggle. Working with the city was the biggest constraint to helping more people.

Detroiters, like most other Americans, have an anti-tax chromosome in our citizenship DNA. An American has visceral tension to the government, and it’s right to confiscate through taxation. We don’t like taxes. PERIOD. FULL STOP. I smell tea every time I hear a politician talking about taxes. An increase, decrease doesn’t matter. Say taxes, and I hear the outgoing tide in the Harbor calling.

However, we understand taxes. It’s pretty clear what fees are for and who authorized their collection: We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity, According to the preamble, we are buying for ourselves and our Posterity:

We, the People, gave the government the power to tax. We did it early, too, Article 1, Section 8. We also realized that taxes inherent confiscatory power make them a threat to liberty. The Bill of Rights limits the ability of the government to infringe on personal freedom. It prohibits explicitly unlawful seizure. Paying Detroit property taxes contributes to urban quality of life. It is irrefutably the responsibility of every property owner to pay property taxes. But you should not pay more than you owe. Our attitude toward all forms of taxation is the same. Tax evasion is a crime. Aggressive tax avoidance is our Constitutional duty.

The government systematically and illegally inflated the values of homes to increase their property tax revenue; then seize homes from families when they could not afford to pay. Legal claims to seek relief have not done well in the courts based on jurisdictional issues, so far.

To paraphrase Baron Rothschild, “When there is blood in the street buy land.” That was the case in Detroit, both literally and figuratively. And that is what the contrarians and speculators did. They took a risk with the expectation of profit. Nothing more American than that. Detroit’s foreclosed real estate sold at distressed prices and in a depressed market. Most of it left derelict with unpaid tax bills. Until economic conditions turned around when Dan Gilbert came to town, then development incentives and tax abatements became readily available for some. That was was not true of another group of investors in Detroit. The most prominent contrarian investors were Detroiters themselves. They hung in, believed in, and stayed in the city. They were committed to its comeback and determined enough to sacrifice their quality of life over the years to maintain a community. These risk-takers had skin in the game. Rather than benefit, they were exploited, dispossessed, and left unable to access the benefits of the city’s comeback fully. For many, housing in the new Detroit is unaffordable. They will not have capital from equity to invest in themselves or their communities. Justice demands restitution for the former homeowners. Redeploy an improved DLBA buyback program for the previous homeowners. One that requires ongoing financial capability training and maintaining non-delinquent water and tax (both income and property) as a 7-year annual buy down to ownership. Another option is to award the former homeowners twice the SEV at the time of the foreclosure. That is the value the city established. Recipients should be required to vet both options through impartial housing counseling agencies.

The city has done an excellent job negotiating affordable housing into recent development agreements. And it’s good to see Dan Gilbert through Bedrock spread the wealth.

So that it isn’t downtown only, the city should do more. DLBA has enough properties to repopulate many of the decimated neighborhoods with affordable housing also. Market rents are rising. The citizens in Detroit should be able to stay in Detroit and not be priced away. Vision and leadership are what is needed. Affordable housing should be a part of any Comeback city vision of Detroit. The people that live in an area now should be able to do so after redevelopment. The leader must see and articulate, “justice was denied, and it should be restored.” Restored to the loyal Detroiters who found themselves caught in a death spiral vortex that led to the largest municipal bankruptcy ever. Their property seized fraudulently by a corrupt, revenue-hungry city. That had neither mercy nor empathy as it feasted on its own? To get it done, leadership needs to rally citizens and others to support the righteousness of the cause. The leader has to neutralize vested entrenched countervailing interest in state and county governments, media, and the private sector. Leadership must also demonstrate the ability to implement and execute a scandal-free program for the benefit of its citizens. Holistic affordable housing programs can achieve this goal. The DLBA has access to single-family homes to provide affordable housing. It should be dispersed throughout the city so that it reduces the concentration of poverty. Promotes greater neighborhood economic diversity and lowers geo-behavioral vulnerability. These illegal foreclosures are just another episode in generations of systematic dispossession of black folks’ wealth by the government. This one should be acknowledged, and its victims made whole. Based on a review of 18th, 19th, and 20th centuries American history, I am not hopeful of a just outcome in this case either.

1 Comment

Read More

Brent Nelson

5/15/2018 07:11:10 pm

My house was illegally foreclosed because of back taxes in 2014. To my surprise, my property had a "land patent" on it from the 1800's and therefore I wasn't responsible for property taxes anyway. I'm currently looking into filing a complaint and possibly taking legal action against the Wayne County Treasurer. I really don't know what else to do. This situation has caused me to lose basically everything I owned and relocate to another state.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed