Archives

May 2020

Categories

All

|

Back to Blog

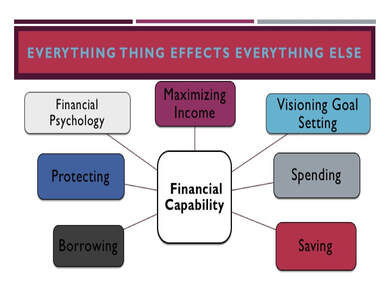

Okay the BK is discharged. Now let's start rebuilding your credit score. This not a quick fix. It also assumes you have effectively dealt with whatever caused you declare bankruptcy whether it be situation, lifestyle, or lack of financial capabilities.

This strategy is front-loaded with a long term payoff because of the BK credit restoration timeline. A BK can be on your credit report for up to 10 years. The good news is that its impact lessens on your credit report the further removed it is from the present. You may be eligible for a mortgage or auto loan in much less time if your other factors are strong. Here are the six steps to rebuild a perfect credit score: 1.Be wary of credit repair companies.

2. Start now. Be patient.

4. Check your credit reports 90 days after BK and then at least annually thereafter.

0 Comments

Read More

Your comment will be posted after it is approved.

Leave a Reply. |

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed