Archives

May 2020

Categories

All

|

Back to Blog

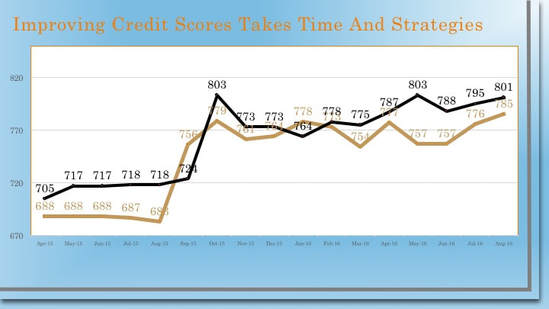

7 Ways to Reverse a Bad Credit Score12/5/2017 If you have bad credit be encouraged you can have good credit, if you want it. Having a “prime” credit score can make a significant beneficial difference in your life. Non-prime credit scores will result in limited more expensive borrowing options, if available at all. Borrowing from time to time is a reality and necessity of modern financial life. Short-term borrowing costs impact your long-term financial well-being. Your ability to minimize those costs is based on your financial capability. In this adversarial economic system, you can either "play the game" or "be played by the game." Credit heals itself. If you do nothing on your credit for the next 7 years you will have a clean credit report by law. The only exception would be the 10 years required for a Chapter 7 bankruptcy to clear. But just waiting for the bad news to fall off your report isn’t good enough. You also need to engage the system for your benefit. But before we begin let’s reel in expectations.

1 Comment

Read More

Robin

12/21/2017 11:15:59 am

Thank you..this information was very valuable.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

||||||||||||

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed