Archives

May 2020

Categories

All

|

Back to Blog

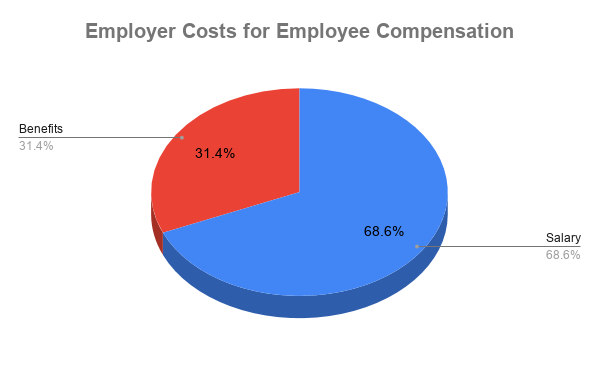

Most employees unnecessarily leave money on the table when it comes to their compensation by not maximizing their employer-provided benefits. According to the BLS, 30% of your compensation is benefits. Let’s look at some strategies to get the most out of your benefits for the rest of this year.

But first a rant about paid vacation days. I realize that 1 in 4 American workers don’t get any paid time off at all. The rest get paid vacation “yet only 51% of paid vacation days are used! More disturbingly (if not surprisingly), 61% of those who do take vacation are “working while on vacation.” Americans left 768 million days of paid time off unused last year, according to research released by the U.S. Travel Association. The study found that 55 percent of Americans did not use all of their paid vacation time.” Why would you do that? Seriously, ask yourself, “why would I do that?” What are the short/long term benefits of this behavior? Here is what to do for the rest of this year. The best time to do this is around October 1. This will give you flexibility before that end of the year time crush everyone experiences. Also, it gives time for any changes in your withholding strategies to take effect and return the expected benefits. Of course, these strategies can be implemented anytime.

0 Comments

Read More

Your comment will be posted after it is approved.

Leave a Reply. |

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed