Archives

May 2020

Categories

All

|

Back to Blog

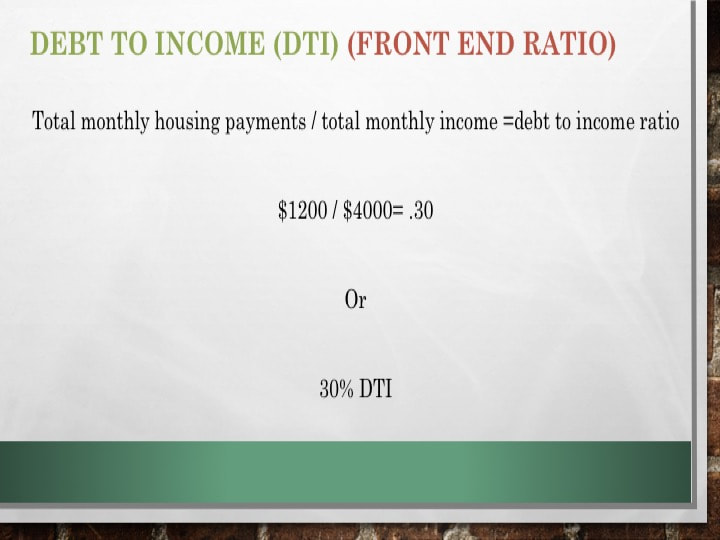

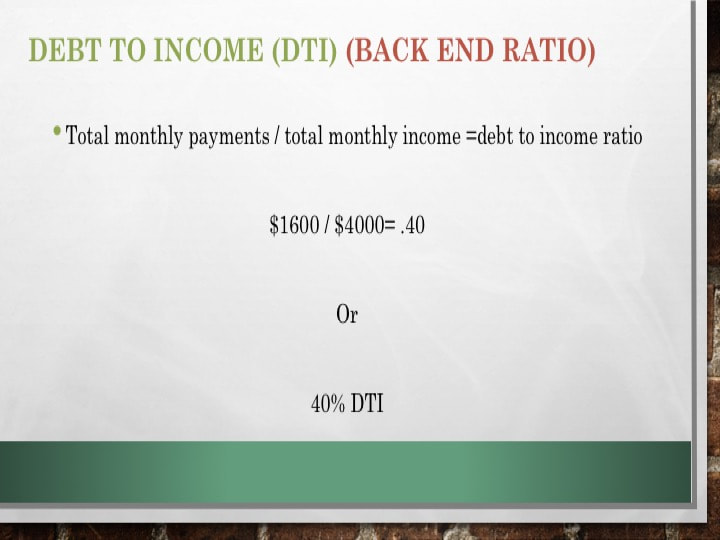

A good credit score is not enough to be mortgage-ready Yes, you need a good credit score. Just as important is your debt-to -income ratio. Your debt to income ratio tells a lender how close you are living to the edge. It is known as DTI. DTI measures the percentage of your gross monthly income is used to service certain debt types. The minimum monthly payment you are obligated to make compared to your verifiable gross monthly income.

There are 2 types of DTI

The front-end ratio, also called the housing ratio, shows what percentage of your income would go toward your housing expenses. housing ratio front-end ratio includes

Back End Ratio The back-end ratio shows what percentage of your income would go toward debt service. It includes

Conventional Loans Lenders typically say the ideal front-end ratio should be no more than 28%. The back ratio, including all expenses, should be 36% or lower. In reality, depending on credit score, savings, and down payment, lenders accept higher ratios. Limits vary depending on the type of loan. For conventional loans, most lenders focus on your back-end ratio. FHA Loans The recommended debt-to-income limit is 31% on the front ratio and 43% for the back ratio. But with certain compensating factors, the FHA automated approval system accepts ratios as high as 46.99% for housing expenses and 56.99% for the total back ratio. Downpayment assistance grants and other first time home buyer programs usually overlay additional DTI underwriting guidelines on a mortgage application. The overlays are not necessarily more restrictive. Some may loosen DTI limits. You should consult with a knowledgeable, experienced loan officer (LO) in first-time homebuyer programs for specific options. This person and your research will be your best resources in finding programs. Be woke to the fact that many of the grants and other applications can be geo-specific even down to the zip code Other DTI Ratio Need to Know

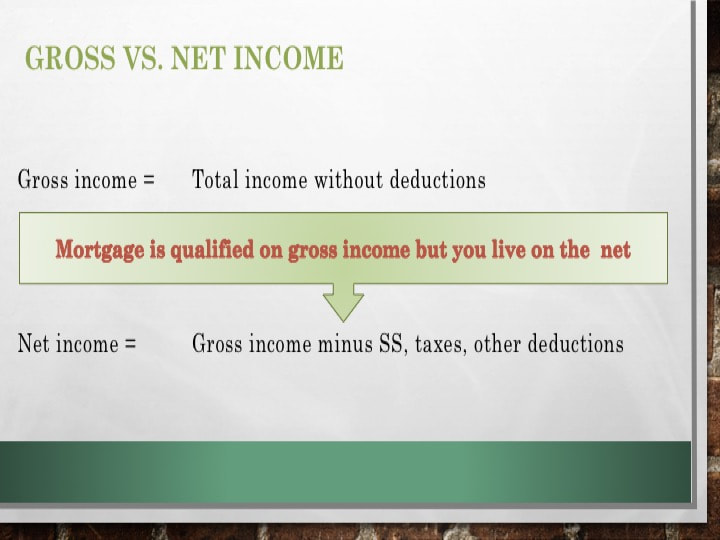

DTI is calculated on GROSS Monthly Income. You live out of NET Monthly Income. This is mainly a consideration when the LO tells you how much home you qualify based on your DTI. You should decide how much of a monthly payment you can afford before you begin the mortgage application process.

0 Comments

Read More

Your comment will be posted after it is approved.

Leave a Reply. |

MONEYSMARTLIFE.ORG EMPOWERING SUSTAINABLE FINANCIAL WELL-BEING IN WORKING CLASS FAMILIES

RSS Feed

RSS Feed